Get Nc Dor E-589ci 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC DoR E-589CI online

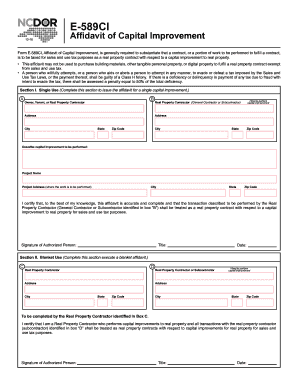

Filling out the NC DoR E-589CI, also known as the Affidavit of Capital Improvement, is essential for substantiating that a particular contract is subject to sales and use tax as a real property contract. This guide will provide you with step-by-step instructions to complete the form effectively online, ensuring you have the necessary information for successful submission.

Follow the steps to complete the NC DoR E-589CI online.

- Click ‘Get Form’ button to access the NC DoR E-589CI form and open it for editing.

- In Section I, Single Use, provide details about the capital improvement: fill in the Owner, Tenant, or Real Property Contractor fields with the appropriate name and address, followed by the general contractor or subcontractor’s information.

- Describe the capital improvement to be performed, ensuring to include the Project Name and Project Address along with the corresponding city, state, and zip code.

- An authorized person needs to certify the form by entering their title, signing, and dating the affidavit.

- If utilizing Section II, Blanket Use, ensure to provide the name and address of the hiring Real Property Contractor in Box C and the subcontractor's information in Box D.

- The authorized person listed in Box C should also sign, enter their title, and date the form.

- After completing the form, save your changes. You can then choose to download, print, or share the form as needed.

Complete and submit your form online today to ensure compliance and streamline your document management.

Get form

Related links form

Yes, you can file the North Carolina Business Registration application (NC BR) online. This streamlined process allows businesses to register for sales tax permits and other taxes with ease. Using the official NC Department of Revenue website simplifies your application process, ensuring you complete the necessary steps efficiently.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.