Loading

Get Nc Dor E-595e 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the NC DoR E-595E online

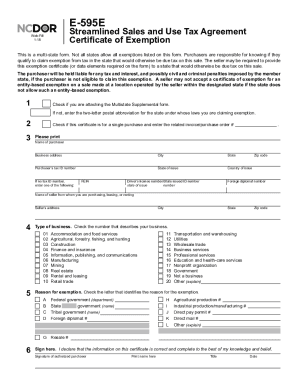

The NC DoR E-595E is a streamlined sales and use tax agreement certificate of exemption that allows purchasers to claim exemption from sales tax on certain purchases. This guide will provide step-by-step instructions on how to effectively complete this form online.

Follow the steps to successfully fill out the NC DoR E-595E online.

- Press the ‘Get Form’ button to obtain the online version of the NC DoR E-595E and access it in the designated area for completion.

- If you are attaching the Multistate Supplemental form, check the appropriate box. If not, enter 'NC' in the postal abbreviation field indicating you are claiming an exemption under North Carolina laws.

- Indicate if this certificate is for a single purchase by checking the box and providing the invoice or purchase order number related to the transaction.

- Fill out the purchaser information section by entering your name, business address, city, state, tax ID number, and other pertinent details as requested.

- Specify the type of business by checking the number that best describes your operation from the given list.

- Select the reason for your exemption by checking the corresponding letter, providing any additional identification number if applicable, or entering 'NA' if not required.

- Sign the form, certifying that the information provided is correct to the best of your knowledge, and print your name, title, and the date.

- Once all fields are completed, save your changes, and you have the option to download, print, or share the completed form as needed.

Complete your NC DoR E-595E online today to streamline your tax exemption process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filling out a withholding exemption form begins by obtaining the correct version from the NC DoR. Provide your personal information and reason for requesting the exemption. Be sure to check the boxes that apply to you, ensuring you accurately represent your tax situation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.