Loading

Get Nc Dor Ro-1033 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC DoR RO-1033 online

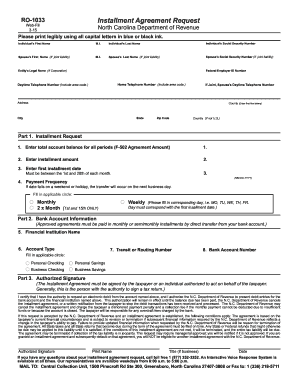

The NC DoR RO-1033 is an installment agreement request form designed for individuals or entities who wish to manage their tax payments over time. This guide will provide clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the NC DoR RO-1033 effectively.

- Click the ‘Get Form’ button to access the online version of the NC DoR RO-1033. This action will open the form in a user-friendly editor.

- Enter your individual first name, middle initial, and last name in the provided fields. Ensure that you include the correct spelling as it appears on your legal documents.

- Input your Social Security number in the designated field to establish your identity for the request.

- If you have joint liability, enter your partner's first name, middle initial, last name, and Social Security number in the corresponding fields.

- If you are representing a corporation, fill in the entity's legal name and the federal employer identification number.

- Provide your home and daytime telephone numbers, ensuring you include the area code.

- Complete your address, including the county (using the first five letters), city, state, zip code, and country if applicable.

- In Part 1, enter the total account balance for all periods in the designated space.

- Indicate the installment amount you wish to propose as part of your payment plan.

- Select a first installment date between the 1st and 28th of the month and enter it in the required format (MM-DD-YYYY).

- Choose your preferred payment frequency by filling in the applicable circle: Monthly, 2 x Month (1st and 15th ONLY), or Weekly. If weekly, specify the day.

- In Part 2, provide the name of your financial institution, account type, transit number, and bank account number.

- Select the circle that matches your account type: Personal Checking, Personal Savings, Business Checking, or Business Savings.

- In Part 3, read the certification statement carefully and then provide your authorized signature, print your name, enter your title if you represent a business, and date the form.

- Once you have filled out all required fields, ensure you have reviewed your entries for accuracy, then save your changes. You may also download, print, or share the form as needed.

Act now to fill out your NC DoR RO-1033 online and manage your tax obligations with ease.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To obtain a withholding tax ID number in North Carolina, you can apply online through the NC DoR or submit a paper application. This identification number is crucial for employers who need to withhold taxes from employee wages. Providing accurate business details will help speed up your application process. More information is available in the NC DoR RO-1033.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.