Loading

Get Nc E-536r 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC E-536R online

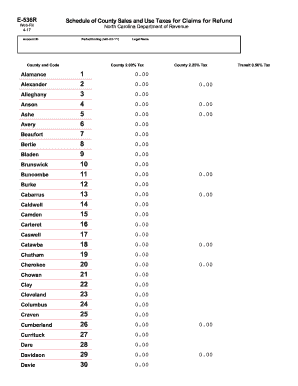

The NC E-536R is a form used for the schedule of county sales and use taxes for claims for refund in North Carolina. This guide provides clear, step-by-step instructions to help users complete the form accurately online.

Follow the steps to successfully complete the NC E-536R online.

- Click the ‘Get Form’ button to access the NC E-536R form. This will allow you to open it in your preferred document editor for completion.

- Fill in the 'Period Ending' field with the appropriate date in MM-DD-YY format. This is crucial for determining the tax period related to your refund claim.

- Enter your 'Account ID' accurately. This identifier is essential for processing your refund claim in relation to your specific account.

- Select the appropriate 'County and Code' from the provided list. Ensure that you choose the county associated with your transactions.

- Complete the 'County 2.00% Tax' and 'County 2.25% Tax' sections based on your reported sales. Input the corresponding amounts as necessary.

- If applicable, fill in the 'Transit 0.50% Tax' section. This applies to certain counties that are subject to this additional tax rate.

- Review all entered information to ensure accuracy. Check for any errors or omissions before finalizing the document.

- Once you have confirmed that all data is correct, save your changes, and use the options to download, print, or share the form as needed.

Start filling out the NC E-536R online today for a seamless claims process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

On the W-4 form, you will indicate 0 or 1 in the section designated for allowances. Typically, if you have dependents or fewer deductions, you may want to claim zero. If your situation allows for a single allowance, mark 1 in the same section to adjust your withholding appropriately based on your tax strategy.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.