Get Nc E-585 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC E-585 online

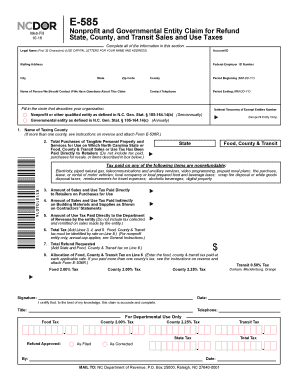

The NC E-585 form is designed for nonprofit and governmental entities seeking refunds for sales and use taxes paid in North Carolina. This guide provides a clear, step-by-step process for completing the form online, ensuring that all users can easily navigate its components.

Follow the steps to successfully complete the NC E-585 form.

- Press the ‘Get Form’ button to access the NC E-585 form and open it in your preferred online editor.

- Complete all sections of the form, including the legal name, account ID, mailing address, and federal employer ID number. Make sure to use capital letters for names and addresses.

- Provide your contact information by filling in the name of the person available for questions, contact telephone number, county, and the period for which the claim is being submitted.

- Select the appropriate circle denoting the type of organization that is filing the claim—either nonprofit or governmental entity.

- For nonprofit entities, specify the name of the taxing county and record the total purchases of tangible personal property and services where tax has been paid directly to retailers.

- Detail the amounts for lines 3 through 6, including sales and use tax paid directly to retailers, indirectly on building materials, and use tax paid to the Department of Revenue.

- Calculate the total tax by adding the relevant lines and specify the total refund requested while ensuring compliance with annual caps if applicable.

- Allocate the food, county, and transit tax amounts on the final line, noting any applicable rates. If taxes were paid in multiple counties, make sure to complete the Form E-536R.

- Review all entered information for accuracy. Once confirmed, you can choose to save your changes, download the completed form, print it, or facilitate sharing as necessary.

Get started now by filling out the NC E-585 form online to claim your tax refunds!

Get form

To request a penalty waiver in NC, write a formal letter to the NC Department of Revenue outlining your reasons for the request. Include any necessary documentation that supports your case, such as personal circumstances or business-related issues. The NC E-585 can serve as part of your overall filing when addressing penalties, providing a comprehensive approach to your financial responsibilities.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.