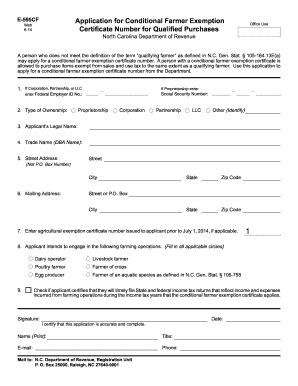

Get Nc E-595cf 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NC E-595CF online

How to fill out and sign NC E-595CF online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, a majority of Americans opt to handle their own tax returns and additionally, to complete forms electronically.

The US Legal Forms web platform simplifies the e-filing process of the NC E-595CF, making it straightforward and free of complications.

Ensure that you have accurately completed and submitted the NC E-595CF by the deadline. Take into account any relevant timeframes. Providing incorrect information in your financial documents can lead to severe penalties and complications with your annual tax return. Only utilize professional templates with US Legal Forms!

- Open the PDF template in the editor.

- Refer to the designated fillable fields where you can enter your information.

- Select the option regarding the checkboxes if you see them.

- Utilize the Text icon along with other potent features to manually modify the NC E-595CF.

- Review all the details before continuing with the signing process.

- Create your unique eSignature using a keyboard, webcam, touchpad, mouse, or mobile device.

- Validate your PDF form online and specify the exact date.

- Click Done to proceed.

- Save or send the document to the intended recipient.

How to Modify Get NC E-595CF 2014: Personalize Documents Online

Appreciate the simplicity of the versatile online editor while completing your Get NC E-595CF 2014. Utilize the assortment of tools to swiftly fill in the blanks and furnish the required information immediately.

Preparing documents is laborious and costly unless you have ready-to-fill forms and complete them digitally. The optimal approach to handle the Get NC E-595CF 2014 is to employ our expert and feature-rich online editing solutions. We equip you with all the essential tools for quick document fill-out and enable you to make any modifications to your forms, tailoring them to various requirements.

Additionally, you can provide feedback on the alterations and leave notes for other participants.

Utilizing Get NC E-595CF 2014 in our powerful online editor is the fastest and most efficient method to manage, submit, and share your documents in the way you desire from any location. The tool operates in the cloud, allowing you to access it from any place with an internet connection. All forms you create or fill are securely stored in the cloud, ensuring that you can access them whenever necessary without the fear of losing them. Stop wasting time on manual document completion and eliminate paper; conduct everything online with minimal effort.

- Fill in the blanks using Text, Cross, Check, Initials, Date, and Sign tools.

- Emphasize critical information with a preferred color or underline it.

- Conceal sensitive data using the Blackout tool or simply delete it.

- Add images to illustrate your Get NC E-595CF 2014.

- Substitute the original text with one that meets your preferences.

- Leave remarks or sticky notes to convey updates to others.

- Add more fillable sections and designate them to specific individuals.

- Secure the template with watermarks, dates, and bates numbers.

- Distribute the documents in various formats and save them on your device or in the cloud once you finish editing.

The NC Department of Revenue administers the state's tax laws and collects various taxes, including income, sales, and property taxes. They play a crucial role in ensuring compliance and providing resources to help taxpayers understand their obligations. If you have questions about your tax status or need assistance, the department is a valuable resource.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.