Loading

Get Ne 7ag-1 (formerly 13ag) 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NE 7AG-1 (Formerly 13AG) online

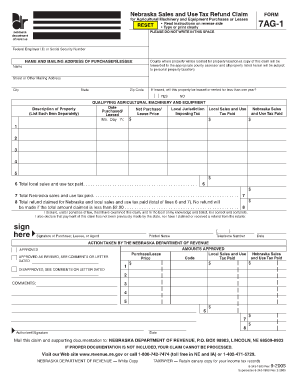

This guide provides a detailed overview of how to complete the NE 7AG-1 form online. Users can efficiently fill out the form to claim a refund for sales and use tax paid on qualifying agricultural machinery and equipment.

Follow the steps to accurately complete your refund claim.

- Click the ‘Get Form’ button to access the NE 7AG-1 form and open it in your editor.

- Begin by entering your Federal Employer I.D. or Social Security Number in the designated field to clearly identify yourself.

- Fill in your name and mailing address as the purchaser or lessee. Ensure that all details are typed or printed clearly.

- Indicate the county where the property will be located for property taxation purposes. This information is essential as a copy of the claim will be sent to the appropriate county assessor.

- If the property is leased, specify whether it will be leased or rented for less than one year by selecting 'YES' or 'NO.'

- List each qualifying agricultural machinery and equipment item separately in the provided section. Ensure to include the date purchased, local jurisdiction, net purchase/lease price, and local sales and use tax paid.

- Calculate and enter the total local sales and use tax paid in the appropriate field.

- Calculate and enter the total Nebraska sales and use tax paid in its designated field.

- Sum lines 6 and 7 to determine the total refund claimed for Nebraska and local sales and use tax paid. Note that no refund will be made if the total amount is less than $2.00.

- Sign the form as the purchaser, lessee, or agent in the 'Sign Here' section, and provide your printed name and telephone number.

- Once all fields are complete, save your changes, and prepare the document for submission. You can download, print, or share the form as necessary.

Complete your NE 7AG-1 form online today to ensure a smooth refund process!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To verify a Nebraska resale certificate, you must check the certificate's number against the records maintained by the Nebraska Department of Revenue. They provide resources for determining the validity of resale certificates. This verification is important to ensure compliance with NE 7AG-1 (Formerly 13AG) standards.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.