Get Ne 8-553-1997 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NE 8-553-1997 online

How to fill out and sign NE 8-553-1997 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, the majority of Americans tend to favor handling their own taxes and additionally, completing forms in digital format. The US Legal Forms online platform facilitates the submission of the NE 8-553-1997 in a straightforward and efficient manner.

It now requires no more than 30 minutes, and you can accomplish it from any place.

Ensure that you have correctly completed and submitted the NE 8-553-1997 in a timely manner. Consider any relevant deadlines. Providing incorrect information on your financial documents can lead to substantial penalties and issues with your yearly tax return. Use only reputable templates with US Legal Forms!

- Access the PDF template in the editor.

- Refer to the specified fillable fields. Here you can enter your details.

- Click on the option to choose if you see the checkboxes.

- Move to the Text tool and other advanced features to manually modify the NE 8-553-1997.

- Review all the information before you continue signing.

- Create your personal eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Validate your web-template electronically and enter the date.

- Click Done to proceed.

- Save or send the document to the intended recipient.

How to Modify Get NE 8-553-1997 2017: Personalize Forms on the Internet

Your swiftly adjustable and adaptable Get NE 8-553-1997 2017 template is just a click away. Utilize our repository equipped with an integrated online editor.

Do you delay finalizing Get NE 8-553-1997 2017 because you genuinely don’t know where to start and how to proceed? We empathize with your situation and possess a fantastic tool for you that has nothing to do with combating your procrastination!

Our online compilation of ready-to-adjust templates lets you sift through and pick from numerous fillable forms tailored for various applications and situations. However, obtaining the file is merely scratching the surface. We provide all the essential tools to complete, sign, and modify the template of your choice without departing from our site.

All you need to do is access the template in the editor. Review the wording of Get NE 8-553-1997 2017 and confirm whether it meets your needs. Start filling out the template using the markup tools to give your form a more structured and tidy appearance.

In conclusion, alongside Get NE 8-553-1997 2017, you will receive:

With our expert solution, your finalized documents are generally legally binding and fully encrypted. We assure the security of your most sensitive information.

Acquire everything you need to produce a professional-looking Get NE 8-553-1997 2017. Make the optimal choice and explore our platform today!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, black out, and amend the current text.

- If the template is intended for others as well, you can include fillable fields and distribute them for others to fill out.

- Once you’re finished completing the template, you can retrieve the file in any available format or choose any sharing or delivery options.

- A comprehensive suite of editing and markup tools.

- An integrated legally-valid eSignature capability.

- The functionality to create documents from scratch or based on the previously uploaded template.

- Compatibility with diverse platforms and devices for enhanced convenience.

- Numerous options for protecting your documents.

- A broad range of delivery methods for simplified sharing and dispatching of documents.

- Adherence to eSignature standards overseeing the use of eSignature in online dealings.

Related links form

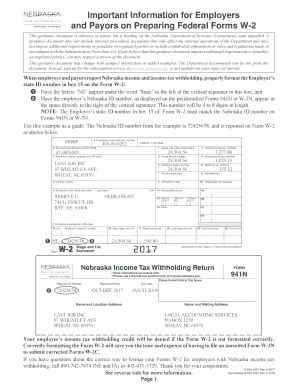

A withholding tax state ID is a number assigned to businesses that withhold state income tax from employees' wages. This ID is essential for reporting and paying the withheld amounts to the state. If you're looking for resources to better understand or obtain your withholding tax state ID, our platform can assist you, especially in relation to NE 8-553-1997.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.