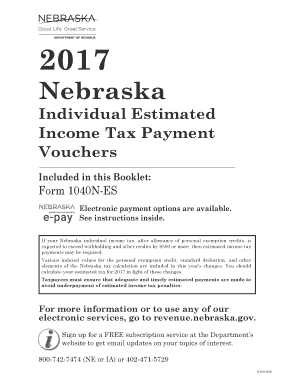

Get Ne Dor 1040n-es 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NE DoR 1040N-ES online

How to fill out and sign NE DoR 1040N-ES online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, the majority of Americans seem to favor completing their own tax returns and, in addition, finishing documents electronically.

The US Legal Forms online service aids in making the e-filing of the NE DoR 1040N-ES straightforward and without stress.

Ensure that you have accurately completed and submitted the NE DoR 1040N-ES on time. Keep in mind any deadlines. Providing incorrect information in your tax documents may result in significant penalties and lead to complications with your annual tax return. Always utilize only verified templates from US Legal Forms!

- Access the PDF template in the editor.

- Review the outlined fillable fields. Here you can input your information.

- Select the option to choose if you notice the checkboxes.

- Advance to the Text icon and other advanced tools to manually adjust the NE DoR 1040N-ES.

- Examine each piece of information before you proceed to sign.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Authorize your document online and add the date.

- Click on Done to move forward.

- Download or send the document to the recipient.

How to modify Get NE DoR 1040N-ES 2017: personalize forms online

Utilize our extensive editor to convert a basic online template into a finalized document. Continue reading to discover how to adjust Get NE DoR 1040N-ES 2017 online effortlessly.

Once you find a suitable Get NE DoR 1040N-ES 2017, all that’s required is to tailor the template to your specifications or legal stipulations. Besides filling out the editable form with precise information, you may wish to eliminate certain clauses in the document that do not pertain to your situation. Conversely, you might want to incorporate some absent conditions from the original template. Our sophisticated document editing tools are the easiest method to amend and modify the document.

The editor allows you to alter the content of any form, even if the file is in PDF format. It is possible to add and remove text, insert fillable fields, and make additional modifications while maintaining the document's original format. Furthermore, you can reorganize the structure of the document by changing the order of the pages.

You don’t need to print the Get NE DoR 1040N-ES 2017 to endorse it. The editor includes electronic signature capabilities. Most forms already come with signature fields. Therefore, you just need to append your signature and request one from the other signing party with a few clicks.

Follow this detailed guide to create your Get NE DoR 1040N-ES 2017:

Once all parties finish the document, you will receive a signed version which you can download, print, and distribute to others.

Our services enable you to save significant amounts of time and minimize the probability of errors in your documents. Enhance your document workflows with efficient editing features and a robust eSignature solution.

- Access the desired template.

- Utilize the toolbar to modify the form to your liking.

- Fill out the form providing accurate data.

- Click on the signature field and incorporate your electronic signature.

- Forward the document for signatures to other necessary signers.

Related links form

Filing Form 1040-ES is necessary if you meet specific income criteria and expect to owe taxes. For residents of Nebraska, utilizing the NE DoR 1040N-ES facilitates this process, as it helps you track your estimated payments throughout the year. Keep in mind that failing to file when required may lead to interest and penalties. It's wise to stay informed and proactive regarding your tax obligations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.