Get Ne Dor 13 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NE DoR 13 online

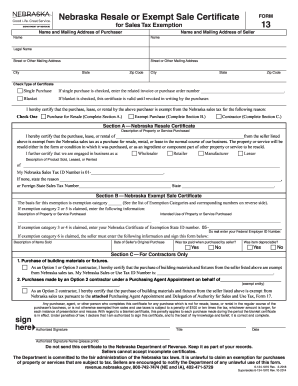

The NE DoR 13 form serves as a Nebraska resale or exempt sale certificate for claiming sales tax exemptions. This guide provides a step-by-step process to help you accurately complete the form online, ensuring you meet all requirements.

Follow the steps to complete the NE DoR 13 form online.

- Press the 'Get Form' button to access the NE DoR 13 form and launch it in the editor.

- Begin by entering the name and mailing address of the purchaser in the designated fields. Ensure to include the legal name, street address, city, state, and zip code.

- Next, input the name and mailing address of the seller, similar to how you entered the purchaser's details.

- Select the type of certificate by marking the appropriate checkbox: 'Single Purchase' or 'Blanket'. If you choose 'Single Purchase,' enter the related invoice or purchase order number in the provided space.

- Indicate the reason for the exemption by checking the relevant box (Purchase for Resale, Exempt Purchase, or Contractor). Follow the instructions to complete the appropriate section based on your choice.

- If you checked 'Purchase for Resale', fill in Section A with a description of the property or service purchased, and indicate the type of business you are engaged in (Wholesaler, Retailer, Manufacturer, or Lessor).

- If you selected 'Exempt Purchase', complete Section B by providing the basis for exemption and the intended use of the property or service purchased. Make sure to enter any necessary exemption category numbers.

- For Section C regarding contractors, provide the required information based on the contractor option you are utilizing and complete the relevant parts accordingly.

- An authorized person must then sign and date the form. Ensure that the signature represents someone with the authority to certify the information provided.

- Finally, review all entries for accuracy. Once confirmed, you can save changes, download, print, or share the completed form as needed.

Start filling out your NE DoR 13 form online today to ensure your sales tax exemptions are documented properly.

Get form

Related links form

The specific days that tax refunds are released can differ each year, often beginning in early February. The Nebraska Department of Revenue announces timelines for releases, and it’s best to check their website or sign up for notifications. Keeping an eye on your NE DoR 13 submission will help you know when to expect your funds. Awareness of these timelines can significantly improve your financial planning.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.