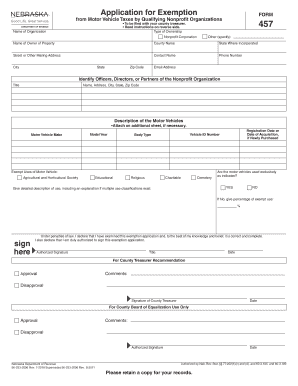

Get Ne Dor 457 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NE DoR 457 online

How to fill out and sign NE DoR 457 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, a majority of Americans choose to handle their own tax returns and, in addition, to complete forms digitally.

The US Legal Forms online platform simplifies and streamlines the submission of the NE DoR 457.

Ensure that you have accurately completed and submitted the NE DoR 457 on time. Keep an eye on any deadlines. Providing incorrect information in your tax documents can result in serious penalties and complications with your annual tax return. Always opt for professional templates from US Legal Forms!

- Launch the PDF template in the editor.

- Look at the designated fillable sections. Here you can add your details.

- Select the option to choose whenever you see the checkboxes.

- Explore the Text tool along with additional robust features to manually edit the NE DoR 457.

- Double-check each detail before you proceed with the signing.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Authenticate your PDF document online and insert the specific date.

- Hit Done to proceed.

- Store or send the document to the intended recipient.

How to Adjust Get NE DoR 457 2018: Personalize Forms Online

Experience a hassle-free and paperless method of adjusting Get NE DoR 457 2018. Utilize our trustworthy online solution to save significant time.

Creating each document, including Get NE DoR 457 2018, from the ground up takes too much time; thus, having a reliable platform of pre-drafted document templates can greatly enhance your efficiency.

Yet, modifying them can be difficult, particularly when dealing with PDF documents. Luckily, our extensive collection features an integrated editor that allows you to swiftly finish and personalize Get NE DoR 457 2018 without needing to leave our site, enabling you to avoid wasting hours on form completion. Here's how to use our tools with your form:

Whether you need to complete editable Get NE DoR 457 2018 or any other form offered in our collection, you’re well on track with our online document editor. It’s straightforward and secure, requiring no specialized technical knowledge. Our web-based tool is designed to handle nearly everything you can contemplate regarding file editing and execution.

Forget the conventional method of managing your forms. Opt for a more effective alternative to assist you in streamlining your tasks and making them less reliant on paper.

- Step 1. Locate the necessary document on our website.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize specialized editing tools that allow you to add, delete, annotate, and highlight or obscure text.

- Step 4. Create and affix a legally-binding signature to your form by using the sign option from the top toolbar.

- Step 5. If the form layout doesn’t appear as you desire, employ the tools on the right to eliminate, add, and organize pages.

- Step 6. Incorporate fillable fields so others can be invited to fill out the form (if needed).

- Step 7. Share or send the document, print it out, or choose the format in which you’d like to receive the document.

Related links form

In Nebraska, the amended tax return is filed using Form 1040X. This form allows you to correct errors on your original return or claim additional deductions or credits. Filing an amended tax return correctly ensures compliance with Nebraska tax regulations. For detailed guidance on completing Form 1040X, refer to the resources available through NE DoR 457.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.