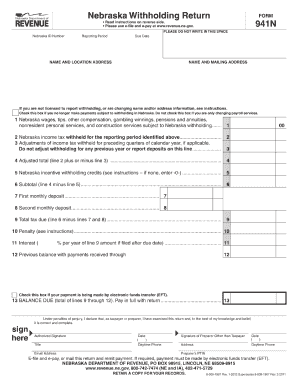

Get Ne Dor 941n 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NE DoR 941N online

How to fill out and sign NE DoR 941N online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

These days, the majority of Americans prefer to handle their own taxes and additionally, to complete forms online.

The US Legal Forms online platform simplifies the process of submitting the NE DoR 941N, making it straightforward and convenient.

Ensure that you have accurately completed and submitted the NE DoR 941N on time. Consider any relevant deadlines. Providing incorrect information in your financial statements can lead to significant penalties and complications with your annual tax return. Use only certified templates with US Legal Forms!

- Access the PDF example in the editor.

- Observe the highlighted fillable areas. This is where you enter your information.

- Select the option to choose if you see the checkboxes.

- Navigate to the Text icon and other useful features to edit the NE DoR 941N manually.

- Review all information before you continue signing.

- Create your custom eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Authenticate your document electronically and enter the date.

- Click Done to proceed.

- Store or send the document to the recipient.

How to Alter Get NE DoR 941N 2012: Personalize Forms Online

Handling documents is more convenient with intelligent online tools. Eliminate paperwork with easily accessible Get NE DoR 941N 2012 templates that you can modify on the web and print.

Preparing documents and paperwork ought to be more straightforward, whether it is a daily aspect of one's job or intermittent tasks. When an individual needs to submit a Get NE DoR 941N 2012, understanding regulations and guidelines on how to accurately complete a form and what it should consist of can be time-consuming and challenging. However, if you locate the right Get NE DoR 941N 2012 template, filling out a document will no longer be a hardship with a clever editor available.

Explore a wider range of features you can incorporate into your document processing routine. No longer do you need to print, fill out, and annotate forms by hand. With a smart editing platform, all the necessary document handling capabilities are always at your fingertips. If you aim to enhance your workflow with Get NE DoR 941N 2012 forms, locate the template in the catalog, click on it, and discover an easier method to complete it.

The more tools you familiarize yourself with, the easier it becomes to work with Get NE DoR 941N 2012. Try the solution that provides everything you need to find and modify forms within a single browser tab and say goodbye to manual paperwork.

- If you wish to insert text in any part of the form or add a text field, utilize the Text and Text field tools and expand the content in the form as much as needed.

- Make use of the Highlight tool to emphasize the key elements of the form. If you want to obscure or eliminate certain text sections, use the Blackout or Erase tools.

- Tailor the form by incorporating default graphic components into it. Employ the Circle, Check, and Cross tools to include these features into the forms when necessary.

- If you require extra comments, use the Sticky note feature and place as many notes on the form page as necessary.

- Should the form need your initials or date, the editor has tools for those functions as well. Reduce the risk of mistakes by utilizing the Initials and Date tools.

- It's also straightforward to add personalized visual elements to the form. Use the Arrow, Line, and Draw tools to modify the file.

Related links form

A state sales tax ID and an Employer Identification Number (EIN) serve different purposes. A sales tax ID is specific for collecting sales tax, while an EIN is used for broader tax and business identification purposes. Understanding these differences is vital while you navigate your NE DoR 941N requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.