Loading

Get Ne Form 5 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NE Form 5 online

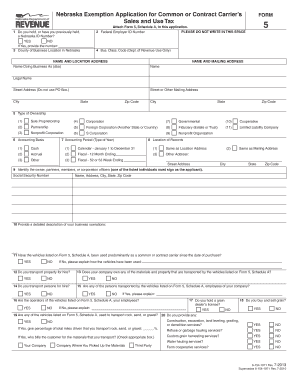

Filling out the NE Form 5 online is an essential process for individuals seeking an exemption from sales and use tax for common or contract carriers in Nebraska. This guide provides step-by-step instructions to ensure that users can complete the form accurately and efficiently.

Follow the steps to fill out the NE Form 5 online with ease.

- Click the ‘Get Form’ button to obtain the NE Form 5 and open it in your preferred online editor.

- Begin by providing your Nebraska ID number in section 1 if applicable, or select 'No' if you have not held one.

- In section 3, enter the county where your business is primarily located in Nebraska.

- Fill out your business information under the name and address section, ensuring to include a physical street address, not a P.O. Box.

- Select the type of ownership from the options in section 5, indicating whether you operate as a sole proprietorship, partnership, corporation, or another entity.

- Indicate your accounting basis in section 6, choosing between cash or accrual methods.

- Provide the location of your business records in section 8, ensuring that it contains sufficient detail for potential audits.

- Specify the accounting period type in section 7, either Calendar or Fiscal, and provide corresponding details.

- Identify the owner, partners, members, or corporate officers in section 9, including their names, addresses, and social security numbers.

- Provide a comprehensive description of your business operations in section 10.

- Respond to the questions from section 11 to section 25 accurately, reflecting your current and future business operations.

- Once all sections are completed, review the form for accuracy, then save your changes, and proceed to download, print, or share the completed form as needed.

Ready to file the NE Form 5 online? Begin the process today to secure your sales and use tax exemption.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

When asked if you are exempt from withholding, you should consider your tax situation. If you had no tax liability in the previous year and expect none in the current year, you may answer 'yes.' However, if you are unsure, consult with a tax professional or use available resources on the uslegalforms platform to clarify your status before completing the NE Form 5.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.