Loading

Get Nh Pa-28 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NH PA-28 online

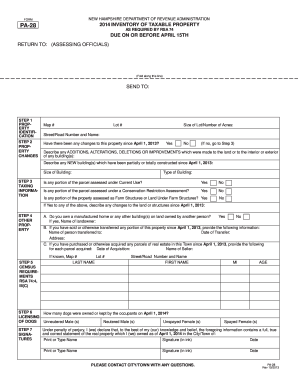

The NH PA-28 form is essential for reporting taxable property in New Hampshire. This guide provides clear, step-by-step instructions on how to fill out the form online, ensuring a smooth experience for all users.

Follow the steps to accurately complete your NH PA-28 online.

- Press the ‘Get Form’ button to access the NH PA-28 form, which will open it in a digital format.

- In Step 1, provide your property identification information including the Map number, Lot number, size of the lot, and the street or road number and name.

- For Step 2, indicate if there have been any changes to the property since April 1, 2013. If changes have occurred, describe the additions, alterations, deletions, or improvements made to the land or any buildings.

- In Step 3, answer if any portion of the parcel is assessed under Current Use, Conservation Restriction Assessment, or Farm Structures. If applicable, provide details on any changes since April 1, 2013.

- For Step 4A, state whether you own a manufactured home or any buildings on land owned by another person and provide the landowner's name if applicable. In Step 4B, report any sales or transfers of the property since April 1, 2013, including the new owner’s name and transfer date. In Step 4C, list any parcels of real estate acquired in the town since April 1, 2013.

- Step 5 involves entering the last name, first name, middle initial, and age of each person occupying the property as of April 1, 2014. If there are no occupants, indicate '0'.

- In Step 6, note how many dogs were owned or kept by the occupants on April 1, 2014. Lastly, in Step 7, all property owners must sign and print their names in ink to declare the information is complete and accurate.

Complete the NH PA-28 form online today to ensure your property inventory is accurately reported.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can request an extension on corporate taxes in New Hampshire. This involves filing the NH PA-28 form, which grants you more time to prepare and submit your tax return. Utilizing this extension can help you manage your finances better and avoid any unnecessary stress as the deadline approaches.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.