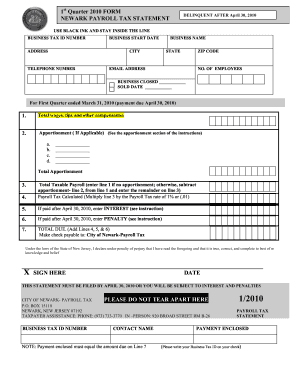

Get Nj 1st Quarter Payroll Tax Statement 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NJ 1st Quarter Payroll Tax Statement online

How to fill out and sign NJ 1st Quarter Payroll Tax Statement online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, the majority of Americans prefer to handle their own income tax filings and, additionally, to fill out forms online.

The US Legal Forms online service simplifies the process of filing the NJ 1st Quarter Payroll Tax Statement, making it convenient.

Ensure that you have accurately completed and submitted the NJ 1st Quarter Payroll Tax Statement by the deadline. Take note of any due dates. Providing incorrect information with your financial documents can lead to severe penalties and complications with your yearly tax return. Make sure to only utilize professional templates from US Legal Forms!

- Open the PDF template in the editor.

- Observe the highlighted fillable fields where you should enter your information.

- Select the checkbox option if you find any.

- Use the Text tool and other advanced features to edit the NJ 1st Quarter Payroll Tax Statement manually.

- Verify all information before proceeding to sign.

- Create your personalized eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Sign your PDF document electronically and add the date.

- Click on Done to continue.

- Download or send the document to the recipient.

How to modify Get NJ 1st Quarter Payroll Tax Statement 2010: personalize forms online

Select a trustworthy document editing solution you can rely on. Alter, complete, and validate Get NJ 1st Quarter Payroll Tax Statement 2010 securely online.

Frequently, adjusting forms, such as Get NJ 1st Quarter Payroll Tax Statement 2010, can be a struggle, particularly if you received them in a digital format but lack specialized tools. Certainly, there are alternative methods to navigate this issue, but you may end up with a document that doesn't meet the submission criteria. Using a printer and scanner is also not a solution, as it is both time-consuming and resource-intensive.

We provide a simpler and more effective approach to filling out forms. An extensive range of document templates that are easy to personalize and verify, making them fillable for certain users. Our solution goes far beyond just a collection of templates. One of the most advantageous features of utilizing our services is the ability to modify Get NJ 1st Quarter Payroll Tax Statement 2010 directly on our website.

Being a web-based platform, it spares you from the necessity of downloading any software. Additionally, not all company policies permit downloads on corporate devices. Here’s the most efficient method to effortlessly and securely complete your documentation with our platform.

Bid farewell to paper and other ineffective strategies for processing your Get NJ 1st Quarter Payroll Tax Statement 2010 or additional forms. Opt for our tool instead, which comprises one of the most extensive libraries of ready-to-personalize templates and efficient file editing services. It's simple and safe, and can save you considerable time! Don’t just take our word for it; try it out yourself!

- Select the Get Form > you'll be instantly directed to our editor.

- Upon opening, you can commence the editing process.

- Choose checkmark or circle, line, arrow and cross among other options to annotate your form.

- Select the date field to insert a specific date into your document.

- Incorporate text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields feature on the right to add fillable {fields.

- Click Sign from the upper toolbar to create and insert your legally-recognized signature.

- Hit DONE and save, print, and distribute or download the completed {file.

Related links form

Calculating quarterly payroll taxes involves estimating your total earnings, deducting applicable withholdings, and applying the correct tax rates. Using the NJ 1st Quarter Payroll Tax Statement simplifies this process by offering structured guidelines and calculations. This ensures that your estimates are both accurate and compliant with state tax laws.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.