Loading

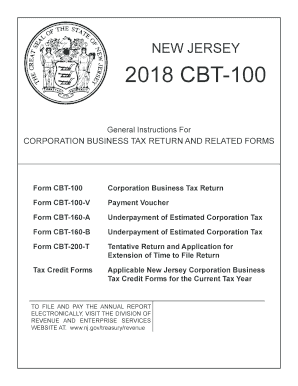

Get Nj Cbt-100 Instructions 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ CBT-100 Instructions online

Completing the NJ Corporation Business Tax Return (CBT-100) can feel overwhelming. This guide provides clear, step-by-step instructions to help you fill out the form accurately and efficiently online.

Follow the steps to complete your NJ CBT-100 form online.

- Press the 'Get Form' button to access the form and open it in your online document editor.

- Begin by entering your Federal Employer Identification Number, New Jersey Corporation Number, corporation name, complete address, and zip code in the designated spaces at the top of the form.

- Complete the principal business activity code from your federal tax return, and indicate the location of your corporate books. Also, provide a contact person and telephone number.

- If the corporation was inactive during the year, ensure to complete pages 1 through 4 and Schedule I for the Certification of Inactivity.

- Fill out all applicable schedules and questions as indicated throughout the instruction manual. Remember to answer every item; if an item does not apply, write 'No' or 'None'.

- Conclude by reviewing your entries for accuracy before saving your document. You can then choose to download, print, or share your completed form.

Submit your NJ CBT-100 form online today to ensure timely processing!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The CBT tax rate in New Jersey is tiered based on a corporation's taxable income. Different rates are applicable depending on income brackets, as outlined in the NJ CBT-100 Instructions. Staying informed about your specific tax rate can help you budget for your business's financial obligations. Understanding this helps you take proactive steps in tax preparation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.