Loading

Get Nj Dot St-8 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ DoT ST-8 online

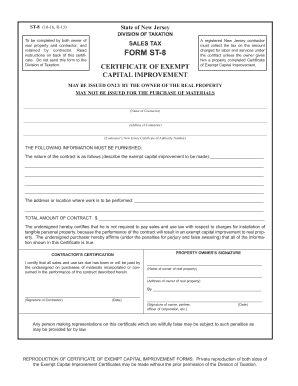

Filling out the NJ DoT ST-8 certificate of exempt capital improvement is essential for both property owners and contractors in New Jersey. This guide provides step-by-step instructions to help you navigate the online form efficiently and accurately.

Follow the steps to complete your NJ DoT ST-8 form online.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering the name of the contractor in the designated field.

- Fill in the address of the contractor, ensuring all details are correct.

- Input the contractor’s New Jersey Certificate of Authority number as required.

- Describe the nature of the exempt capital improvement to be made in the provided section.

- Enter the address or location where the work is to be performed clearly.

- State the total amount of the contract in the specified space.

- Both the property owner and contractor must sign and date the form where indicated.

- Once all fields are completed, users can save the changes, download, print, or share the form as necessary.

Complete your NJ DoT ST-8 form online today to ensure proper documentation for your exemption!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To fill out a certificate of exemption, start by gathering necessary documentation and confirming the exemption type. Accurately complete all sections of the form, including pertinent identification numbers and details related to the exemption reason. It's critical to follow the guidelines closely to avoid errors. If you need a template or guidance, US Legal Forms is an excellent resource.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.