Get Nj Ppt-1 (formerly Ppt-6-b) 1999

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ PPT-1 (Formerly PPT-6-B) online

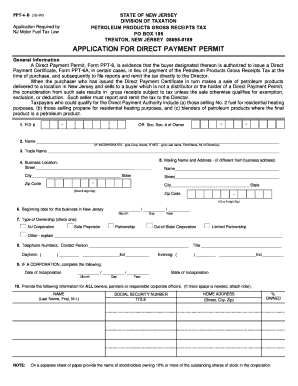

Filling out the NJ PPT-1 (Formerly PPT-6-B) form online is a straightforward process that allows users to apply for a Direct Payment Permit regarding petroleum products. This guide will provide you with a step-by-step approach to accurately complete each section of the form.

Follow the steps to fill out the NJ PPT-1 (Formerly PPT-6-B) online

- Press the ‘Get Form’ button to access the document and open it for editing.

- Enter the FID number or Social Security number of the owner at the top of the form.

- In section two, input the full name of the individual or corporation making the application. If incorporated, provide the corporate name; if not, include the last name, first name, and middle initial.

- For section three, fill in the trade name under which the business operates.

- Provide the complete business location, including the street address, city, state, and zip code, in section four.

- If the mailing address differs from the business address, enter it in section five, ensuring to include the city, state, and 9-digit zip code.

- Indicate the beginning date for the business in New Jersey in section six, using the specified month, day, and year format.

- In section seven, check one box indicating the type of ownership of the business.

- For section eight, provide the contact person's name and both daytime and evening telephone numbers.

- If the applicant is a corporation, complete section nine with the date of incorporation and state of incorporation.

- List all owners, partners, or responsible corporate officers in section ten, along with their social security numbers, titles, home addresses, and percentages owned.

- If applicable, identify any parent company, wholly owned subsidiaries, and/or affiliates in section eleven.

- Designate a registered agent in New Jersey or provide the agent's contact details in section twelve.

- List all suppliers of petroleum products in section thirteen.

- In section fourteen, note whether the applicant is registered for any other New Jersey State taxes and provide details if applicable.

- Choose the type of business activity in section fifteen by checking the appropriate box.

- Provide a detailed description of the business operation and why the applicant qualifies for a Direct Payment Permit in section sixteen.

- If applicable, describe the types of petroleum products to be blended and their percentages in section seventeen.

- In the last section, ensure that the applicant signs and dates the form to verify that all information is true and accurate.

- After completing all sections, save your changes, download the document, print a copy for your records, or share it as necessary.

Start filling out the NJ PPT-1 (Formerly PPT-6-B) online today to secure your Direct Payment Permit.

Get form

Related links form

Yes, New Jersey requires corporations to file for an extension using the NJ PPT-1 (Formerly PPT-6-B) if they cannot meet the filing deadline. This extension provides additional time to prepare the necessary documents and avoid penalties. It is a helpful tool for maintaining compliance with state law. Consider uslegalforms for guidance on filing your corporate extension efficiently.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.