Loading

Get Nj Reg-1e 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ REG-1E online

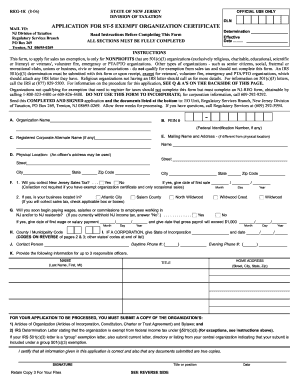

Filling out the NJ REG-1E form is an essential step for nonprofit organizations seeking a sales tax exemption in New Jersey. This guide provides clear and supportive instructions to help users successfully complete the application online.

Follow the steps to complete the NJ REG-1E application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In section A, enter the organization's name and federal identification number, if available. Make sure to provide accurate details for proper identification.

- In section B, fill in the FEIN (Federal Employer Identification Number) if applicable, ensuring correctness to avoid processing delays.

- For section C, provide the registered corporate alternate name, if your organization has one. This helps in maintaining consistency across legal documents.

- In section D, specify the physical location by providing the street address, city, state, and zip code. This should be the main address of the organization.

- Section E is for mailing name and address if different from the physical location. Fill this out to ensure correspondence reaches the correct recipient.

- In section F, answer whether you will collect New Jersey sales tax, providing the date of the first sale if applicable. This is important for compliance.

- Move to section G to indicate if you will begin paying wages to employees in New Jersey, specifying necessary dates if you answer yes.

- In section H, provide the county or municipality code by selecting the appropriate four-digit number from the provided list.

- In section I, indicate the state of incorporation and the incorporation date, if your organization is a corporation.

- Designate a contact person in section J, accompanied by their daytime and evening phone numbers for any inquiries.

- Section K requires information for up to three responsible officers. Fill in their names, home addresses, and titles correctly.

- Before submission, ensure you have included necessary documents as specified in the instructions, such as Articles of Organization and the IRS determination letter.

- Finally, review all entered information for accuracy, sign and date the application in the designated area, and keep a copy for your records. Then, submit the application as instructed.

Complete your NJ REG-1E application online today to ensure your organization's tax-exempt status.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To check the status of your NJ anchor rebate, visit the New Jersey Treasury's website and enter the required information. This will provide you with the most current updates related to your rebate application. Keeping this in mind while filling out the NJ REG-1E will ensure that your records are accurate and timely.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.