Get Nm Rpd-41375 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NM RPD-41375 online

How to fill out and sign NM RPD-41375 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, the majority of Americans seem to choose to handle their own tax filings and additionally, to complete documents electronically.

The US Legal Forms online platform assists in streamlining the process of submitting the NM RPD-41375 efficiently and effortlessly.

Make sure you have accurately completed and submitted the NM RPD-41375 by the specified due date. Keep any deadlines in mind. Providing incorrect information with your financial documents may lead to serious penalties and create issues with your annual tax return. Only utilize verified templates with US Legal Forms!

- Launch the PDF template in the editor.

- Look at the highlighted fillable areas. This is where to input your information.

- Select the option if you come across the checkboxes.

- Access the Text icon and other advanced tools to customize the NM RPD-41375 manually.

- Verify all information before you proceed to sign.

- Create your personalized eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Validate your web-template online and add the specific date.

- Click on Done to proceed.

- Store or forward the document to the recipient.

How to modify Get NM RPD-41375 2016: personalize forms online

Choose a dependable document editing service that you can trust.

Alter, complete, and validate Get NM RPD-41375 2016 safely online.

Frequently, altering documents, such as Get NM RPD-41375 2016, can be difficult, particularly if you obtained them in a digital format but lack access to specialized software. Naturally, you might explore some alternatives to navigate this issue, but you risk producing a form that won’t fulfill the submission standards. Using a printer and scanner isn't a solution either, as it's both time-consuming and resource-intensive.

We provide a simpler and more efficient method of finishing files. A comprehensive collection of document templates that are easy to modify and validate, making them fillable for certain users. Our platform goes far beyond just a set of templates. One of the greatest advantages of using our solution is that you can edit Get NM RPD-41375 2016 directly on our website.

Utilize the fillable fields feature on the right to incorporate fillable elements. Click Sign from the top toolbar to create and attach your legally binding signature. Press DONE and save, print, share, or receive the output. Say goodbye to paper and other outdated methods for finalizing your Get NM RPD-41375 2016 or other documents. Use our tool instead, which boasts one of the richest collections of ready-to-edit forms and a powerful document editing feature. It’s straightforward and secure, and can save you a substantial amount of time! Don’t just take our word for it, give it a try yourself!

- As it’s a web-based service, it eliminates the need for any software installation.

- Additionally, not all corporate policies allow the downloading of applications on corporate computers.

- Here’s how you can quickly and securely complete your forms with our platform.

- Click the Get Form > you’ll be swiftly redirected to our editor.

- Once opened, you can begin the editing procedure.

- Choose checkmark or circle, line, arrow and cross and other options to annotate your form.

- Select the date field to insert a specific date into your template.

- Add text boxes, images, notes, and more to enhance the content.

Related links form

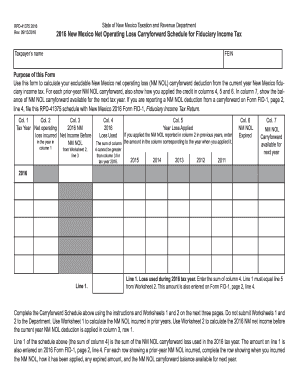

The New Mexico low and middle income tax exemption offers tax relief to individuals and families who fall within specific income brackets. The criteria and benefits of this exemption are detailed in the NM RPD-41375. This financial assistance can significantly impact your disposable income, helping you manage everyday expenses. To take advantage of this exemption, review the income thresholds and ensure you complete the necessary forms correctly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.