Get Nm Trd Pit-110 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

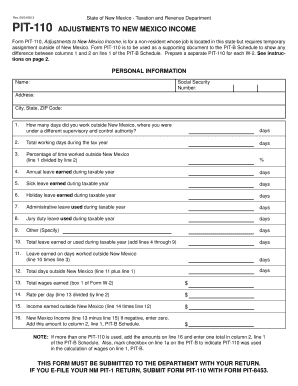

Tips on how to fill out, edit and sign NM TRD PIT-110 online

How to fill out and sign NM TRD PIT-110 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, the majority of Americans choose to handle their own tax returns and, in reality, to complete reports electronically. The US Legal Forms online platform simplifies the procedure of preparing the NM TRD PIT-110, making it easy and straightforward. It now requires no more than thirty minutes, and you can accomplish it from any location.

How you can submit NM TRD PIT-110 swiftly and effortlessly:

Ensure that you have accurately filled out and submitted the NM TRD PIT-110 on time. Be mindful of any deadlines. Providing incorrect information in your financial reports can lead to significant penalties and complications with your annual tax return. Always utilize only official templates with US Legal Forms!

- Open the PDF template in the editor.

- Observe the highlighted fillable sections. Here, you can insert your information.

- Select the option if you notice the checkboxes.

- Utilize the Text tool along with other advanced functionalities to modify the NM TRD PIT-110 manually.

- Review every detail before proceeding to sign.

- Generate your unique eSignature using a keypad, camera, touchpad, mouse, or smartphone.

- Authenticate your document electronically and specify the exact date.

- Click on Done to proceed.

- Download or send the document to the recipient.

How to modify Get NM TRD PIT-110 2013: tailor forms online

Streamline your document creation workflow and adjust it to your specifications within moments. Fill out and endorse Get NM TRD PIT-110 2013 using an effective yet user-friendly online editor.

Handling paperwork is consistently challenging, especially when tackled infrequently. It requires you to meticulously follow all protocols and accurately populate every section with complete and correct information. However, it frequently happens that you wish to alter the document or append additional sections to complete. If you need to enhance Get NM TRD PIT-110 2013 before submitting it, the simplest method to do so is by utilizing our extensive yet easy-to-navigate online editing tools.

This broad PDF editing service allows you to efficiently and swiftly finalize legal documents from any device with internet access, make straightforward edits to the template, and incorporate extra fillable fields. The platform lets you select a specific zone for each type of information, such as Name, Signature, Currency, and SSN, etc. You have the option to make them obligatory or conditional and designate who should fill out each section by assigning it to a specified recipient.

Follow the steps below to alter your Get NM TRD PIT-110 2013 online:

Our editor is a dynamic multi-functional online tool that can assist you in quickly and smoothly adjusting Get NM TRD PIT-110 2013 along with various other forms to meet your needs. Reduce document preparation and submission duration and ensure your forms are professionally styled without difficulty.

- Access the necessary document from the directory.

- Fill in the gaps with Text and position Check and Cross icons to the checkboxes.

- Utilize the right-side toolbar to modify the template with new fillable sections.

- Select the fields based on the type of information you wish to collect.

- Make these fields mandatory, elective, and conditional and tailor their sequence.

- Allocate each section to a specific party using the Add Signer feature.

- Verify if you’ve implemented all required modifications and click Done.

Related links form

CRS numbers are identifiers used in New Mexico to streamline the collection of various taxes for businesses. Each business receives a unique CRS number, serving as an essential reference for filing taxes like the NM TRD PIT-110. These numbers simplify tax compliance for both businesses and the state.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.