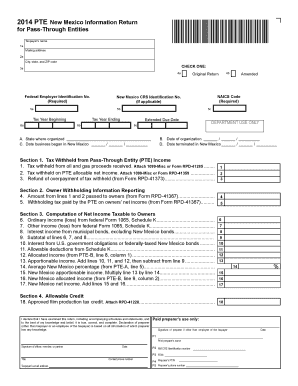

Get Nm Trd Pte 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NM TRD PTE online

How to fill out and sign NM TRD PTE online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, the majority of Americans prefer to handle their own tax returns and indeed, to finalize documents electronically.

The US Legal Forms online platform simplifies the submission process for the NM TRD PTE, making it straightforward and free from complications.

Ensure that you have filled out and submitted the NM TRD PTE accurately and punctually. Review any relevant deadlines. Providing incorrect information in your financial reports may lead to severe penalties and complications with your annual tax return. Always utilize professional templates from US Legal Forms!

- Access the PDF form in the editor.

- Identify the highlighted fillable areas. This is where you will enter your information.

- Select the options if the checkboxes are visible.

- Explore the Text tool along with other advanced features to personalize the NM TRD PTE manually.

- Verify all details prior to signing.

- Create your custom eSignature using a keypad, digital camera, touchpad, mouse, or smartphone.

- Authenticate your PDF document online and indicate the date.

- Click Done to proceed.

- Download or forward the document to the recipient.

How to update Get NM TRD PTE 2014: personalize forms online

Select a dependable document modification option that you can trust. Alter, complete, and validate Get NM TRD PTE 2014 securely online.

Frequently, handling forms, such as Get NM TRD PTE 2014, can be a struggle, particularly if you received them in a digital format but lack access to specialized software. Certainly, you can use some alternatives to bypass this, but you risk producing a form that won't satisfy the submission criteria. Employing a printer and scanner isn’t a viable solution either as it consumes time and resources.

We offer a simpler and more effective method of finishing documents. A comprehensive collection of document templates that are straightforward to modify and validate, and then make fillable for others. Our solution extends well beyond just a set of templates. One of the finest features of utilizing our option is that you can amend Get NM TRD PTE 2014 directly on our platform.

Being a web-based solution, it relieves you from having to install any software application. Moreover, not all corporate policies allow you to install it on your office computer. Here’s the optimal way to easily and securely complete your documents using our solution.

Bid farewell to paper and other inefficient methods of completing your Get NM TRD PTE 2014 or other forms. Utilize our tool instead, which features one of the most extensive libraries of customizable templates and a robust file editing option. It's simple and secure, and can save you a considerable amount of time! Don't just take our word for it, give it a try yourself!

- Click the Get Form > you'll be swiftly directed to our editor.

- Once open, you can start the personalization process.

- Select checkmark or circle, line, arrow and cross, and other options to mark your form.

- Choose the date field to incorporate a specific date into your document.

- Insert text boxes, graphics, notes, and more to enhance the content.

- Use the fillable fields option on the right to add fillable {fields.

- Select Sign from the top toolbar to create and affix your legally-binding signature.

- Press DONE and save, print, share, or download the document.

Related links form

Making a New Mexico PTE election involves a few straightforward steps. First, you need to complete the required election form and submit it to the New Mexico Taxation and Revenue Department within the designated timeframe. USLegalForms can assist you with the necessary documents and ensure that you follow the proper procedures, helping you streamline this important process under the NM TRD PTE regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.