Get Nm Trd Rpd-41071 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

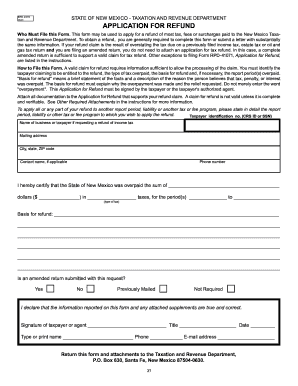

Tips on how to fill out, edit and sign NM TRD RPD-41071 online

How to fill out and sign NM TRD RPD-41071 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, the majority of Americans usually choose to handle their own tax returns and also complete documents electronically.

The US Legal Forms online platform simplifies the process of e-filing the NM TRD RPD-41071, making it straightforward and stress-free.

Ensure that you have accurately completed and submitted the NM TRD RPD-41071 by the deadline. Consider any relevant timing. Providing incorrect information on your financial reports could result in serious penalties and complications with your annual tax return. Always utilize authorized templates from US Legal Forms!

- Launch the PDF template in the editor.

- Notice the highlighted fillable sections. Here, you can add your details.

- Select the option if you spot the checkboxes.

- Explore the Text tool and other robust features to personalize the NM TRD RPD-41071 manually.

- Verify all information before proceeding with the signature.

- Generate your distinct eSignature using a keypad, camera, touchpad, mouse, or smartphone.

- Authorize your PDF form electronically and indicate the date.

- Click on Done to submit.

- Download or forward the document to the recipient.

How to modify Get NM TRD RPD-41071 2015: personalize forms online

Equip yourself with the right document management features at your convenience. Execute Get NM TRD RPD-41071 2015 with our dependable service that merges editing and eSignature capabilities.

If you wish to finish and sign Get NM TRD RPD-41071 2015 online effortlessly, then our cloud-based solution is ideal. We offer an extensive template library of pre-made forms that you can modify and complete online. Furthermore, there's no need to print the document or utilize external solutions to make it fillable. All essential tools will be accessible as soon as you open the file in the editor.

Let’s explore our online editing functionalities and their key attributes. The editor features an intuitive interface, so it won't take long to grasp how to operate it. We’ll examine three primary sections that allow you to:

The upper toolbar includes instruments that assist you in highlighting and obscuring text, without images (lines, arrows, checkmarks, etc.), signing, initializing, dating the document, and more.

Utilize the left toolbar if you wish to rearrange the document or eliminate pages.

If you want to create the document fillable for others and share it, you can utilize the right-side tools to insert various fillable fields, signature and date sections, text boxes, etc. Additionally, beyond the features mentioned above, you can protect your file with a password, apply a watermark, convert the document to the desired format, and much more. Our editor simplifies the process of completing and certifying Get NM TRD RPD-41071 2015. It empowers you to manage everything related to forms. Moreover, we consistently assure that your experience with documents is secure and adheres to the primary regulatory standards. All these factors enhance the enjoyment of using our solution. Retrieve Get NM TRD RPD-41071 2015, implement the necessary revisions and modifications, and obtain it in your preferred file format. Give it a try today!

- Alter and annotate the template

- Arrange your documents

- Prepare them for distribution

Get form

To get a business tax identification number in New Mexico, you must register your business with the New Mexico TRD. This process can be completed online, and the TRD will guide you through the necessary steps. Having this identification number is important for using forms such as the NM TRD RPD-41071.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.