Loading

Get Nm Trd Rpd-41285 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NM TRD RPD-41285 online

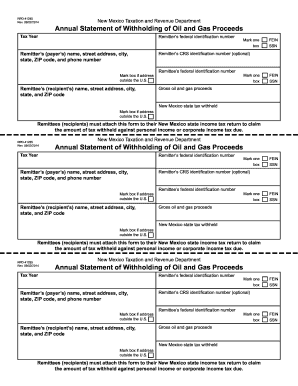

The NM TRD RPD-41285 form is essential for reporting the annual statement of withholding of oil and gas proceeds in New Mexico. This guide will provide clear and supportive instructions to help you accurately complete the form online, ensuring compliance with state requirements.

Follow the steps to complete the NM TRD RPD-41285 online effectively.

- Press the ‘Get Form’ button to acquire the NM TRD RPD-41285 form and launch it in your preferred editing tool.

- Enter the tax year in the designated field.

- Fill in the remitter's federal identification number using hyphens as required.

- Complete the remitter's name and address fields, including city, state, ZIP code, and phone number. Indicate if the address is outside the U.S. by marking the appropriate box.

- Optionally, you can provide the remitter's Combined Reporting System (CRS) identification number.

- Next, record the remittee's (recipient's) name and address, including city, state, and ZIP code. If their address is outside the U.S., mark the appropriate box.

- Enter the remittee's federal identification number, selecting between FEIN and SSN by marking the corresponding box.

- Document the gross oil and gas proceeds from wells located in New Mexico.

- Detail the amount of New Mexico state tax withheld.

- After completing the form, ensure to save the document. You can then download, print, or share the form as required.

Complete your NM TRD RPD-41285 form online to ensure timely and accurate filing.

Related links form

To fill out a tax withholding form for a new job, start by obtaining the W-4 form from your employer. Carefully provide all required personal information, including your filing status and any allowances. Ensure that your deductions align with your tax situation to avoid underpayment. If you need help with this, USLegalForms can offer you a step-by-step approach.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.