Loading

Get Ny Cpf - Warwick

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY CPF - Warwick online

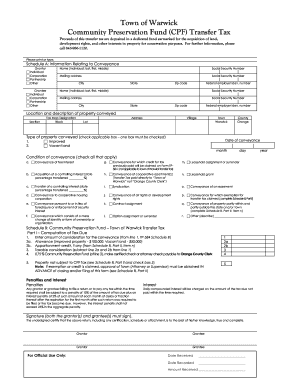

This guide provides a detailed walkthrough for users on how to complete the NY Community Preservation Fund (CPF) Transfer Tax form online. Whether you are familiar with legal documents or a first-time user, this step-by-step approach will help you fill out the form accurately.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to access the NY CPF - Warwick form and open it in your preferred editor.

- In the 'Schedule A' section, identify the grantor's type by selecting one of the options: Individual, Corporation, Partnership, or Other. Enter the grantor's full name, Social Security number, and mailing address.

- Next, provide the grantee's information by selecting their type and entering their full name, Social Security number, and mailing address.

- Fill in the property details, including the location and description of the conveyed property. Include the Section, Tax Map Designation, Block, and Lot numbers.

- Select the type of property conveyed by checking one applicable box indicating whether it is improved or vacant land.

- Indicate the date of conveyance in the relevant section and provide details regarding the condition of the conveyance by checking all that apply.

- Go to 'Schedule B - Computation of Tax Due' and fill in the requisite financial information. This includes the amount of consideration for the conveyance and any allowances.

- If necessary, check the box for property not subject to CPF Tax, and remember that any exemption must be pre-approved.

- Both grantor and grantee need to sign the form to certify that the information provided is true and complete.

- Once all sections are completed, you can save changes, download, print, or share the document as needed.

Complete your NY CPF - Warwick form online now and ensure your transaction is compliant!

Yes, the NY transfer tax may be subject to a gross-up provision, depending on the transaction size and nature. This means that the tax can be calculated on a higher base if certain criteria are met. Understanding these nuances can be complex, but US Legal Forms can offer guidance tailored to your needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.