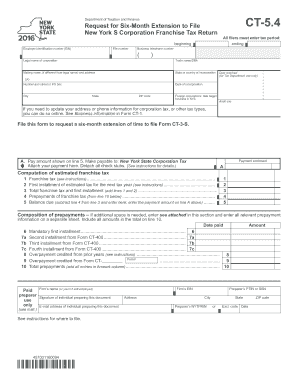

Get Ny Ct-5.4 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY CT-5.4 online

How to fill out and sign NY CT-5.4 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, the majority of Americans prefer to handle their own tax returns and, indeed, to finalize documents electronically. The US Legal Forms web platform facilitates the process of filing the NY CT-5.4 quickly and conveniently. Presently, it takes no longer than thirty minutes, and you can do it from anywhere.

Suggestions for completing the NY CT-5.4 swiftly and easily:

Ensure that you have accurately completed and dispatched the NY CT-5.4 in a timely manner. Be mindful of any deadlines. Providing incorrect information in your financial documents can result in severe penalties and complications with your yearly tax filing. Make sure to utilize only professional templates from US Legal Forms!

- Examine the PDF template in the editor.

- Look at the specified fillable areas. Here you can input your information.

- Select the option if you spot the checkboxes.

- Navigate to the Text icon and other advanced features to manually adjust the NY CT-5.4.

- Verify all the details before finalizing your signature.

- Create your unique eSignature using a keyboard, digital camera, touchpad, mouse or smartphone.

- Authenticate your online template electronically and indicate the date.

- Select Done to proceed.

- Download or send the document to the intended recipient.

How to modify Get NY CT-5.4 2016: personalize documents online

Put the right document alteration features within your reach. Implement Get NY CT-5.4 2016 with our trustworthy service that includes editing and electronic signature capabilities.

If you aim to complete and validate Get NY CT-5.4 2016 online effortlessly, then our online cloud-based solution is the ideal choice. We provide a rich template-based library of ready-to-use documents that you can modify and complete online. Moreover, there’s no need to print the document or utilize external tools to make it editable. All the essential functionalities will be instantly available as soon as you access the file in the editor.

Let’s explore our online editing features and their key aspects. The editor boasts a user-friendly interface, so it won’t take long to understand how to use it. We’ll examine three primary sections that allow you to:

Besides the aforementioned functionalities, you can protect your document with a password, apply a watermark, convert the document to the required format, and much more.

Our editor makes amending and certifying the Get NY CT-5.4 2016 straightforward. It empowers you to perform nearly everything concerning document management. Furthermore, we always prioritize ensuring that your experience editing documents is secure and adheres to the primary regulatory standards. All these elements make utilizing our tool even more enjoyable.

Obtain Get NY CT-5.4 2016, execute the necessary modifications and alterations, and download it in the preferred file format. Try it out today!

- Alter and remark on the template

- The upper toolbar includes the functions that help you emphasize and redact text, without images and graphical components (lines, arrows, checkmarks, etc.), affix your signature, initialize, date the document, and more.

- Organize your documents

- Utilize the left toolbar if you want to rearrange the document or/and remove pages.

- Prepare them for dissemination

- If you wish to make the template fillable for others and distribute it, you can employ the tools on the right and insert various fillable fields, signature and date, text box, etc.

Related links form

To write a check to New York State income tax, begin by writing the date at the top. Next, make the check payable to 'New York State Department of Taxation,' and fill in the amount due in both numbers and words. Don’t forget to include the specifics about your NY CT-5.4 payment in the memo line to streamline processing. Also, keep a copy for your records to track your payments.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.