Loading

Get Ny Ct-6 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY CT-6 online

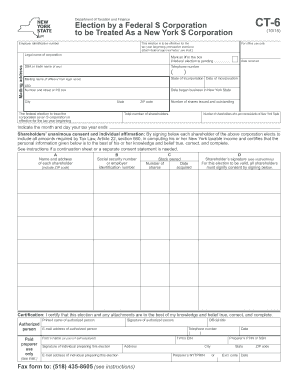

Filing the NY CT-6 form is an essential step for federal S corporations seeking to be treated as New York S corporations. This guide provides a clear and straightforward approach to completing the form online, ensuring that users can navigate each section with ease.

Follow the steps to fill out the NY CT-6 online effectively.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Begin by entering your employer identification number. This number is crucial for processing your election as it uniquely identifies your corporation.

- Fill in the legal name of your corporation as registered. Make sure this aligns with official documents.

- If applicable, mark an X in the designated box to indicate if a federal election is pending. This informs the tax authority of your current election status.

- Provide the mailing address for your corporation. Ensure that the address is accurate to receive any correspondence regarding your application.

- If your corporation has a DBA (doing business as) or trade name, enter it in the provided section.

- Indicate the state of incorporation and the date of incorporation, ensuring that these details match your legal documents.

- Fill out the mailing name if it differs from the legal name. This might be necessary for different divisions or branches.

- Enter the telephone number for the corporation, ensuring that it is a working number where you can be reached.

- Input the date the business commenced operations in New York State, as this may affect your tax obligations.

- List the number of shares issued and outstanding, as well as the total number of shareholders, including nonresidents of New York State.

- Indicate the month and day that your corporation's tax year concludes. This impacts tax filings and deadlines.

- Each shareholder must provide their name, address, social security number or employer identification number, stock owned, date shares were acquired, and signature to signify consent for the election.

- For authorization, an authorized person must certify the accuracy of the election by providing their printed name, signature, phone number, and email address.

- If a paid preparer assists, their information must also be included, following the same requirements for certification.

- Finally, review all entries for completeness and accuracy, then choose to save changes, download, print, or share the form.

Complete your NY CT-6 form online today to ensure your S corporation status is accurately reflected.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To find the latest mailing address or fax number for filing Form 2553, go to IRS.gov and enter "Where to file Form 2553" in the search box.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.