Loading

Get Ny Dtf Ct-200-v 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF CT-200-V online

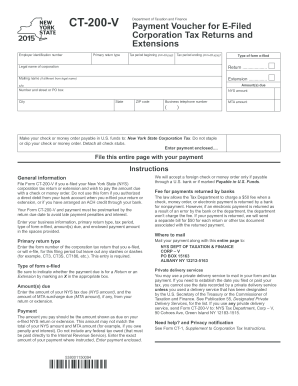

Filling out the NY DTF CT-200-V form online can streamline your tax payment process for New York State corporation taxes. This guide provides clear, step-by-step instructions to ensure you complete the form accurately.

Follow the steps to complete the NY DTF CT-200-V form online.

- Click ‘Get Form’ button to access the NY DTF CT-200-V form and open it in your preferred online editor.

- Enter your employer identification number in the designated field. This number is crucial for identifying your corporation.

- Specify the primary return type by entering the form number of the corporation tax return you e-filed for this period, omitting any slashes or dashes.

- Provide the tax period beginning and ending dates in the required format (mm-dd-yyyy). This informs the tax authorities of the period your return covers.

- Indicate the type of form you e-filed, marking an X in the appropriate box for either 'Return' or 'Extension'.

- Input the legal name of your corporation and, if applicable, the mailing name (if different). Make sure to provide accurate information to avoid issues during processing.

- Complete the address section including the number and street or PO box, city, state, and ZIP code, ensuring correctness for correspondence.

- Enter your business telephone number for any follow-up communication from the tax department.

- Clearly enter the amounts due; include the NYS amount and the MTA amount if applicable, as specified in your e-filed return.

- Fill in the payment enclosed amount, ensuring this reflects the total payment you intend to make, based on your return or extension.

- Once all fields are completed, save your changes. You can download or print the form as necessary for your records and remittance.

- Mail the completed form along with your check or money order to the specified address, ensuring it is sent before the due date to avoid penalties.

Complete your documents online to ensure a smooth filing experience!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

NYS DTF tax payment is a term that describes any payment made toward state taxes due to the New York State Department of Taxation and Finance. This includes income tax, sales tax, and various other state-specific taxes. The NY DTF CT-200-V plays an important role when making these payments, especially for estimated taxes. To ensure you stay informed about your payment obligations, consider platforms like uslegalforms for resources.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.