Loading

Get Ny Dtf Ct-3 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF CT-3 online

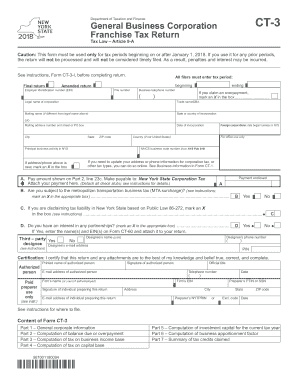

The NY DTF CT-3 is the general business corporation franchise tax return for tax periods beginning on or after January 1, 2018. This guide provides a step-by-step approach to assist users in accurately filling out the form online.

Follow the steps to complete the NY DTF CT-3 online.

- Press the ‘Get Form’ button to obtain the CT-3 form and open it in the editing interface.

- Enter the required tax period, ensuring to differentiate between beginning and ending dates as appropriate.

- Provide your employer identification number (EIN) and file number accurately to facilitate processing.

- Fill in the legal name of the corporation and, if applicable, the trade name or DBA.

- Input the mailing address, including city, state, and ZIP code, and indicate if this information has recently changed.

- If applicable, mark the box to indicate if you're filing an amended return and provide the necessary details.

- Complete Part 1 by marking any applicable qualifications for preferential tax rates in the provided section.

- Move on to the computation sections, carefully recording your business income, capital base, and investment capital according to the instructions.

- Document your business apportionment factor calculations to ensure accurate tax computations.

- Summarize any tax credits claimed in Part 7, ensuring you have the appropriate documentation attached.

- Review all information entered for accuracy before saving your form, which can be downloaded, printed, or shared.

Complete your documents online with confidence and ensure timely submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To file the CT 3 in New York, you need to submit your form to the New York State Department of Taxation and Finance. You can file online through their e-file system, or you can mail your completed form to the specified address listed on the form instructions. Ensuring that you file accurately and on time helps avoid penalties. For any assistance related to the NY DTF CT-3, consider using platforms like USLegalForms to simplify the process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.