Loading

Get Ny Dtf Ct-3 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF CT-3 online

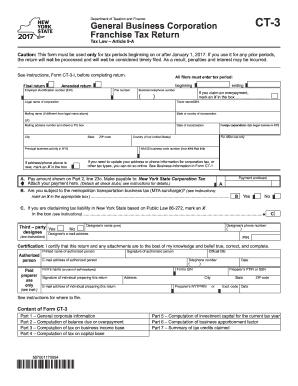

This guide provides a comprehensive overview of how to complete the NY Department of Taxation and Finance CT-3 form online. It is essential for business corporations to accurately fill out this form to comply with New York State tax laws.

Follow the steps to fill out the NY DTF CT-3 form online.

- Press the ‘Get Form’ button to access the CT-3 form and open it in your preferred editor.

- Enter the tax period information at the top of the form, indicating both the starting and ending dates. This section is crucial for the accurate processing of your return.

- Provide your Employer Identification Number (EIN) and the file number. These identifiers are important for matching your return with your tax records.

- Fill in the general corporate information, including the legal name, trade name (if applicable), and mailing address. Ensure all details are correct to avoid any issues with your submission.

- Indicate whether this is a final or amended return by checking the appropriate box.

- Complete the section on payments. If you are enclosing a payment, make sure to specify the amount and attach it as directed.

- Navigate through Parts 1 to 7, filling in the necessary computations for your business income base, capital base, investment capital, and any applicable tax credits claimed.

- Review all entries for accuracy, ensure all required attachments are included and mark any boxes for exemptions or special conditions that apply to your situation.

- Lastly, save your work. You can download, print, or share the completed form as required before submitting it according to the filing instructions.

Complete your NY DTF CT-3 form online today to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The capital base tax in New York is calculated by determining a corporation's total capital and applying the statutory rate as outlined in the NY DTF CT-3 instructions. Ensure you account for all relevant taxable capital to avoid underreporting. For assistance, consider using uslegalforms to navigate the complexities of tax calculation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.