Loading

Get Ny Dtf Ct-34-sh 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF CT-34-SH online

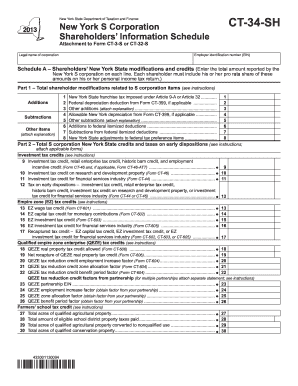

The NY DTF CT-34-SH form is a crucial document for New York S corporation shareholders, detailing modifications and credits related to New York State taxes. This guide provides step-by-step instructions for completing the form online, ensuring clarity and accuracy in your submission.

Follow the steps to successfully fill out the form.

- Press the ‘Get Form’ button to acquire the CT-34-SH form and open it in the online editor.

- In the first section, enter the legal name of the corporation and its employer identification number (EIN) in the designated fields.

- Proceed to Schedule A, where you will need to report total shareholder modifications. For each line, input the total amounts as reported by the New York S corporation. Ensure that these figures are reflective of each shareholder's pro rata share.

- In Part 1, list any additions and subtractions regarding modifications related to the S corporation. For additions, include the New York State franchise tax and other applicable deductions. For subtractions, ensure to attach explanations if required.

- Navigate to Part 2, which focuses on New York State credits and taxes on early dispositions. Here, input details for various tax credits, such as investment tax credits or EZ tax credits. Be diligent in attaching the necessary forms.

- Complete Schedule B by entering identifying information for each shareholder. Make photocopies of Schedule B as needed, and ensure that all entries are accurate and complete.

- Review the entire form for completeness and accuracy. Once satisfied, you can save changes, download a copy for your records, print, or share the form as needed.

Complete your NY DTF CT-34-SH form online today for a streamlined filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

When you receive nonresident income from New York sources, it means you have earned income in New York while residing in another state. This income is subject to New York taxes, and you'll need to report it using the appropriate forms. It’s wise to consult forms such as the NY DTF CT-34-SH to ensure your tax filings are accurate.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.