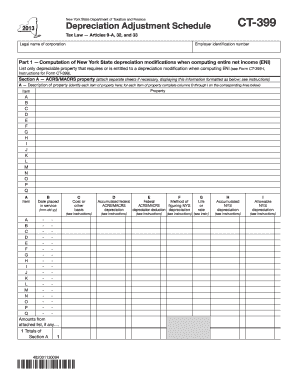

Get Ny Dtf Ct-399 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF CT-399 online

How to fill out and sign NY DTF CT-399 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Nowadays, a majority of Americans prefer to handle their own tax filings and indeed to complete documents electronically.

The US Legal Forms online service simplifies the task of filing the NY DTF CT-399, making it straightforward and efficient.

Ensure that you have accurately completed and submitted the NY DTF CT-399 on time. Be aware of any deadlines. Providing incorrect information in your financial statements may lead to severe penalties and complications with your annual tax filing. Utilize only professional templates from US Legal Forms!

- Open the PDF form in the editor.

- Observe the designated fillable sections. This is where you can enter your information.

- Select the option if checkboxes are visible.

- Access the Text tool and additional advanced features to customize the NY DTF CT-399 manually.

- Review all information before you proceed with signing.

- Create your unique eSignature using a keyboard, digital camera, touchpad, mouse, or smartphone.

- Authenticate your PDF form digitally and indicate the date.

- Click on Done to continue.

- Download or send the document to the intended recipient.

How to modify Get NY DTF CT-399 2013: personalize forms online

Take advantage of the intuitive nature of the feature-rich online editor while completing your Get NY DTF CT-399 2013. Utilize the variety of tools to quickly fill in the blanks and submit the required information without delay.

Filling out documents can be labor-intensive and costly unless you have pre-prepared electronic templates to complete them digitally. The easiest method to handle the Get NY DTF CT-399 2013 is to utilize our expert and versatile online editing solutions. We equip you with all the essential tools for swift form completion and allow you to modify any forms, tailoring them to specific needs. Additionally, you can provide feedback on the changes and leave notes for others involved.

Here’s what you can accomplish with your Get NY DTF CT-399 2013 in our editor:

Utilizing the Get NY DTF CT-399 2013 in our powerful online editor is the fastest and most effective method to organize, submit, and share your documents as per your requirements from any location. The tool operates from the cloud, allowing you to access it from any internet-enabled device. All forms you create or complete are safely stored in the cloud, enabling you to retrieve them anytime you need without the risk of losing them. Stop spending time on manual document filling and eliminate paper usage; perform everything online with minimal effort.

- Fill in the blanks using Text, Cross, Check, Initials, Date, and Signature tools.

- Emphasize important details with a preferred color or underline them.

- Conceal sensitive information with the Blackout tool or simply erase it.

- Add images to illustrate your Get NY DTF CT-399 2013.

- Substitute the original text with one that meets your needs.

- Provide comments or sticky notes to converse with others about the revisions.

- Create additional fillable sections and assign them to specific recipients.

- Secure the document with watermarks, add dates, and bates numbers.

- Distribute the document in various formats and save it on your device or the cloud once you complete the editing.

In New York City, the mortgage recording tax can be substantial and is calculated as a percentage of the mortgage amount. The percentage may vary depending on the mortgage's total size and the property type. Being informed about the mortgage recording tax helps you budget effectively, and the NY DTF CT-399 provides essential guidance in understanding these financial responsibilities. Resources like USLegalForms offer valuable tools for navigating this complex landscape.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.