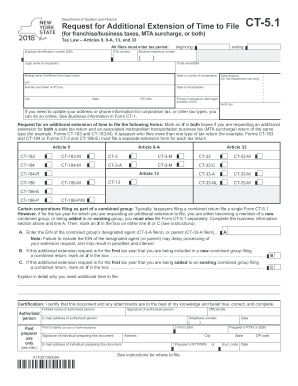

Get Ny Dtf Ct-5.1 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF CT-5.1 online

How to fill out and sign NY DTF CT-5.1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, the majority of Americans opt to complete their own income tax returns and, indeed, to fill out forms electronically.

The US Legal Forms online platform facilitates the process of preparing the NY DTF CT-5.1 swiftly and conveniently. Presently, it requires no more than thirty minutes, and you can do it from anywhere.

Ensure that you have accurately completed and submitted the NY DTF CT-5.1 by the specified due date. Keep in mind any timelines. If you provide incorrect information in your tax documents, it may result in significant penalties and complications with your annual tax return. Utilize only certified templates with US Legal Forms!

- Open the PDF template in the editor.

- Notice the highlighted fillable areas. Here you can enter your details.

- Click on the option to select if you see the checkboxes.

- Navigate to the Text icon and other powerful features to manually adjust the NY DTF CT-5.1.

- Verify each detail before proceeding to sign.

- Create your unique eSignature using a keypad, webcam, touchpad, mouse, or smartphone.

- Validate your document online and input the specific date.

- Click Done to proceed.

- Save or forward the document to the recipient.

How to Modify Get NY DTF CT-5.1 2018: tailor forms online

Explore a dedicated service to manage all your documentation effortlessly.

Locate, adjust, and finalize your Get NY DTF CT-5.1 2018 within a single platform using advanced tools.

The era where individuals needed to print forms or even manually write them is a thing of the past. Currently, accessing and completing any form, such as Get NY DTF CT-5.1 2018, simply requires opening a single browser tab. Here, you will discover the Get NY DTF CT-5.1 2018 form and tailor it to your requirements, from entering text directly in the document to sketching it on a digital sticky note and attaching it to the file. Uncover tools that will streamline your documentation without added hassle.

Just click the Get form button to quickly prepare your Get NY DTF CT-5.1 2018 documentation and begin modifying it immediately. In the editing mode, you can effortlessly populate the template with your details for submission. Simply click on the field you wish to adjust and input the information right away. The editor's interface does not necessitate any special skills to navigate. Once you complete the edits, review the accuracy of the information once again and endorse the document. Click on the signature field and adhere to the instructions to eSign the form in no time.

Completing Get NY DTF CT-5.1 2018 forms will no longer be a challenge if you know where to find the right template and prepare it effortlessly. Do not hesitate to give it a try.

- Utilize Cross, Check, or Circle tools to highlight the document's information.

- Incorporate text or fillable text areas with text customization options.

- Delete, Highlight, or Obscure text segments in the document using respective tools.

- Insert a date, initials, or even an image to the document if needed.

- Employ the Sticky note tool to comment on the form.

- Use the Arrow and Line, or Draw tool to add graphic elements to your document.

Related links form

When writing a check to New York State for income tax, ensure you include your identification number on the check to ensure proper credit. Write the check payable to 'New York State Department of Taxation and Finance.' Additionally, include the tax year and form number in the memo section for clarity. If you have questions about this process, platforms like USLegalForms can offer templates and guidelines to assist you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.