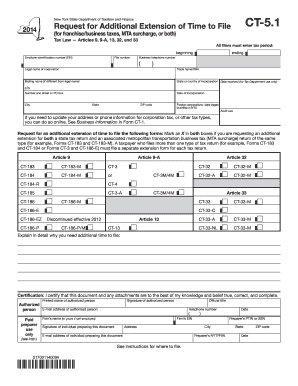

Get Ny Dtf Ct-5.1 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF CT-5.1 online

How to fill out and sign NY DTF CT-5.1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, the majority of Americans choose to complete their own tax returns and, in reality, to fill out documents electronically.

The US Legal Forms web platform facilitates the process of completing the NY DTF CT-5.1 swiftly and efficiently.

Ensure that you have accurately completed and submitted the NY DTF CT-5.1 by the deadline. Consider any time constraints. Providing incorrect information in your financial statements may lead to serious penalties and complications with your yearly tax return. Make sure to utilize only professional templates from US Legal Forms!

- Launch the PDF form in the editor.

- Identify the designated fillable fields. This is where to enter your information.

- Select the option if you notice the checkboxes.

- Navigate to the Text icon and other robust features to manually modify the NY DTF CT-5.1.

- Verify all the information before you proceed with signing.

- Generate your personalized eSignature using a keyboard, digital camera, touch screen, mouse, or smartphone.

- Validate your PDF form online and indicate the date.

- Click on Done to continue.

- Store or dispatch the document to the recipient.

How to Alter Get NY DTF CT-5.1 2014: Personalize Forms Online

Managing documents is easier with intelligent online resources. Eliminate physical paperwork with effortlessly downloadable Get NY DTF CT-5.1 2014 templates that you can tailor online and print out.

Preparing documents and forms should be simpler, whether it is a routine task of one’s job or sporadic work. When needing to file a Get NY DTF CT-5.1 2014, learning rules and instructions on how to properly complete a form and what it must contain can consume a lot of time and energy. However, if you discover the correct Get NY DTF CT-5.1 2014 template, completing a document will no longer be a hassle with a clever editor available.

Explore a broader array of features you can incorporate into your document workflow. There's no need to print, complete, and mark forms by hand. With an intelligent editing platform, all the vital document management features will always be accessible. To enhance your workflow with Get NY DTF CT-5.1 2014 forms, locate the template in the catalog, select it, and experience a more straightforward approach to filling it out.

The more tools you are acquainted with, the easier it is to work with Get NY DTF CT-5.1 2014. Explore the solution that offers everything necessary to locate and alter forms within a single tab of your web browser and leave behind manual paperwork.

- If you wish to add text in a specific area of the form or place a text field, utilize the Text and Text field tools and extend the text in the form as extensively as you desire.

- Benefit from the Highlight tool to emphasize the significant parts of the form. If you need to obscure or delete certain text portions, utilize the Blackout or Erase features.

- Personalize the form by integrating standard graphic components into it. Employ the Circle, Check, and Cross tools to incorporate these elements into the forms as needed.

- If the form requires extra notes, utilize the Sticky note feature and place as many notes on the forms page as necessary.

- If the form requires your initials or date, the editor provides tools for that as well. Reduce the chance of mistakes by using the Initials and Date features.

- It is also feasible to include custom graphic elements into the form. Use the Arrow, Line, and Draw tools to personalize the document.

Related links form

If you are a resident of New York City or earn income there, you will likely need to file a NYC tax return. This filing is separate from your state tax return. Using the NY DTF CT-5.1 simplifies your responsibilities when it comes to tax compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.