Get Ny Dtf Ct-636 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF CT-636 online

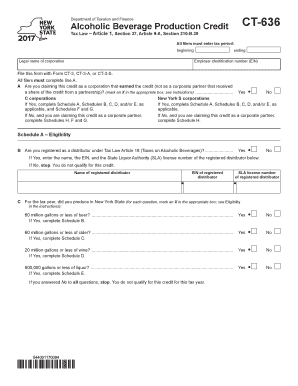

The NY DTF CT-636 form, also known as the Alcoholic Beverage Production Credit, is designed for corporations claiming credits under specific tax laws. This guide provides a clear, step-by-step approach to filling out the form online, ensuring users have the necessary information to complete their filing accurately.

Follow the steps to complete the NY DTF CT-636 online.

- Click the ‘Get Form’ button to access the NY DTF CT-636 form and open it in your preferred document editor.

- Begin by entering the tax period at the top of the form. Indicate the beginning and ending dates clearly without omissions.

- Complete line A to confirm whether you are claiming this credit as a corporation that earned the credit directly. Mark an 'X' in the appropriate box.

- For Schedule A – Eligibility, confirm whether you are registered as a distributor under Tax Law Article 18.

- You will then respond to questions regarding the production quantities for beer, cider, wine, and liquor. Mark 'Yes' or 'No' for each production quantity based on the limits provided.

- Calculate the credits on Schedules B through E based on the provided guidelines, ensuring to multiply correctly as per the instructions given for each section.

- Complete Schedule F for total credits, ensuring you summarize the total alcoholic beverage production credit accurately.

- If you are a partnership, fill out Schedule H with the necessary details of each partnership where you received a share of the credit.

- After reviewing all inputted information for accuracy, proceed to save your changes. You may also download, print, or share the completed form as needed.

Complete your NY DTF CT-636 form online today to ensure timely and accurate filing.

Get form

To become exempt from sales tax in New York, you need to complete the NY DTF CT-636 form and provide valid reasons for your exemption. This may include being a nonprofit organization or making purchases for resale. Make sure to follow the guidelines correctly to ensure your exemption is recognized, and consider using platforms like uslegalforms for assistance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.