Get Ny Dtf Et-133 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF ET-133 online

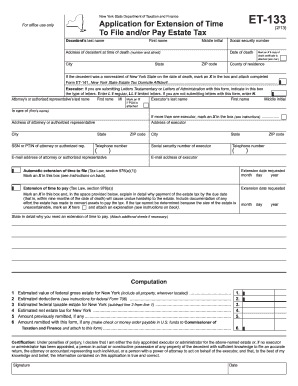

Filling out the NY DTF ET-133 form online can be a straightforward process when you have a comprehensive guide. This document serves as an application for an extension of time to file and/or pay estate tax in New York. Follow the steps outlined below to complete the form accurately and efficiently.

Follow the steps to fill out the NY DTF ET-133 online.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- In the section for decedent’s information, carefully enter the last name, first name, middle initial, social security number, and address of the decedent at the time of death. Include the date of death, city, county of residence, state, and ZIP code.

- If you are attaching a copy of the death certificate, mark an X in the designated box. Additionally, if the decedent was a nonresident of New York State at the time of death, mark the appropriate box and ensure you attach completed Form ET-141.

- For the executor information, indicate the type of letters (regular or limited) if you are submitting Letters Testamentary or Letters of Administration. Otherwise, mark N if no letters are being submitted. Fill in the executor’s name, address, social security number, and contact information.

- If applicable, complete the fields for the attorney's or authorized representative’s information, including their name, address, social security number or PTIN, and phone number.

- Mark an X in the box for the automatic extension of time to file if you are applying for it and provide the requested extension date.

- For an extension of time to pay, mark the appropriate box and provide a detailed explanation of why payment will cause undue hardship. Attach any necessary documentation to support your claim.

- Proceed to the computation section and fill in the estimated value of the federal gross estate, estimated deductions, estimated taxable estate, estimated net estate tax, and any amounts previously remitted, if applicable.

- Review the certification statement and ensure you sign and date it. This declaration confirms that all information provided is accurate.

- At this final step, you can save changes, download the form, print it for submission, or share it as needed.

Complete your NY DTF ET-133 form online today for a smoother estate tax process.

Get form

Related links form

Calculating New York estate tax involves determining the total value of the estate, including assets and debts. You then reference the NY estate tax table to establish the applicable tax rate based on that value. Using the NY DTF ET-133 form ensures that all calculations are documented and compliant with state requirements, simplifying the process for estate representatives.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.