Get Ny Dtf Et-90 2000-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF ET-90 online

How to fill out and sign NY DTF ET-90 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, the majority of Americans choose to handle their own tax returns and, indeed, to fill out forms in digital format. The US Legal Forms web service assists in making the task of preparing the NY DTF ET-90 quick and convenient. Now it takes at most half an hour, and you can accomplish it from any location.

Guidelines on how to complete the NY DTF ET-90 effortlessly and swiftly:

Ensure that you have accurately completed and sent the NY DTF ET-90 on time. Be aware of any deadlines. Providing incorrect information in your tax filings could lead to severe penalties and complications with your annual income tax return. Utilize only professional templates available through US Legal Forms!

- Access the PDF template in the editor.

- Refer to the highlighted fillable sections. Here you can enter your information.

- Click the option to select if you see the checkboxes.

- Navigate to the Text icon along with other advanced features to manually edit the NY DTF ET-90.

- Double-check all the information before you proceed with signing.

- Create your custom eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Certify your online template and indicate the date.

- Press Done to continue.

- Save or send the document to the intended recipient.

How to modify Get NY DTF ET-90 2000: personalize forms online

Authorize and distribute Get NY DTF ET-90 2000 alongside any additional corporation and personal documents online without squandering time and resources on printing and mailing. Maximize our online form editor with an integrated compliant electronic signature feature.

Authorizing and submitting Get NY DTF ET-90 2000 templates digitally is faster and more efficient than handling them in hard copy. However, it necessitates utilizing online solutions that ensure a high level of data protection and provide a compliant instrument for crafting electronic signatures. Our powerful online editor is precisely what you require to prepare your Get NY DTF ET-90 2000 and other personal and business or tax forms in an accurate and suitable manner consistent with all stipulations. It provides all the vital tools to swiftly and effortlessly complete, modify, and endorse documentation online and include Signature fields for additional individuals, specifying who and where they should sign.

Distribute your documentation with others using one of the available methods. When signing Get NY DTF ET-90 2000 through our robust online service, you can always be confident that it will be legally binding and acceptable in court. Prepare and submit your documents in the most advantageous manner available!

- Access the selected document for further editing.

- Utilize the upper toolkit to insert Text, Initials, Image, Check, and Cross annotations into your template.

- Highlight the most important elements and conceal or eliminate sensitive ones if necessary.

- Click on the Sign option above and choose your preferred method to eSign your document.

- Sketch your signature, type it, upload an image of it, or select another method that fits your needs.

- Switch to the Edit Fillable Fields section and position Signature spots for other participants.

- Click on Add Signer and enter your recipient’s email to assign this field to them.

- Ensure that all supplied information is complete and accurate prior to clicking Done.

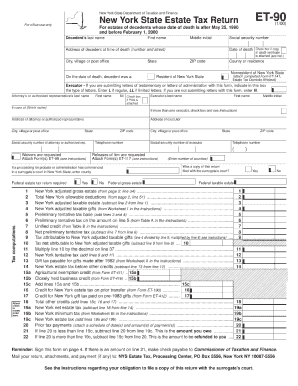

The form used for the estate tax return in New York is the NY Estate Tax Return (Form ET-706). This form is required for estates that exceed the state estate tax threshold. Accurately filing the NY DTF ET-90 alongside Form ET-706 will help ensure compliance with New York estate tax requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.