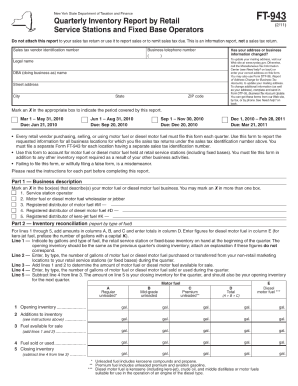

Get Ny Dtf Ft-943 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF FT-943 online

How to fill out and sign NY DTF FT-943 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Nowadays, the majority of Americans choose to manage their own tax submissions and, indeed, to complete documentation digitally.

The US Legal Forms online platform simplifies the task of preparing the NY DTF FT-943, making it straightforward and convenient.

Ensure that you have accurately filled out and dispatched the NY DTF FT-943 on time. Pay attention to any deadlines. Providing incorrect information in your financial statements may lead to severe penalties and complications with your annual tax return. Always utilize certified templates from US Legal Forms!

- Access the PDF template in the editor.

- Review the marked fillable fields where you can enter your details.

- Select the option to indicate if you notice the checkboxes.

- Explore the Text tool alongside other advanced features to personally adjust the NY DTF FT-943.

- Confirm all information before proceeding to sign.

- Create your personalized eSignature using a keyboard, digital camera, touchpad, mouse, or mobile device.

- Authenticate your PDF document online and specify the exact date.

- Click Done to proceed.

- Store or transmit the document to the recipient.

How to modify Get NY DTF FT-943 2011: personalize forms online

Utilize our powerful web-based document editor to optimize your paperwork. Fill out the Get NY DTF FT-943 2011, highlight the crucial details, and smoothly implement any other necessary alterations to its text.

Creating documents digitally is not just efficient but also enables you to adjust the template according to your specifications. When handling the Get NY DTF FT-943 2011, consider finishing it with our extensive online editing tools. If you encounter a typo or input information incorrectly, you can quickly revise the document without the need to start over as you would with traditional filling methods. Additionally, you can emphasize key information in your documents by coloring, underlining, or encircling specific content.

Follow these straightforward steps to finalize and adjust your Get NY DTF FT-943 2011 online:

Our robust online tools provide the easiest method to complete and adjust the Get NY DTF FT-943 2011 according to your requirements. Utilize it to prepare personal or business documentation from anywhere. Access it in a browser, make any adjustments to your forms, and revisit them at any time in the future - all will be securely stored in the cloud.

- Access the file in the editor.

- Fill in the required fields using Text, Check, and Cross tools.

- Follow the form navigation to ensure you complete all necessary sections of the template.

- Encircle some of the vital details and add a URL to it if needed.

- Use the Highlight or Line features to emphasize the most important pieces of text.

- Choose colors and line thickness to enhance the professional appearance of your form.

- Remove or black out the information you wish to be hidden from others.

- Correct erroneous content and enter the necessary text.

- Conclude modifications by hitting the Done button once you verify that everything is accurate in the document.

Related links form

NY special tax refers to additional taxes imposed on certain goods or services beyond the standard sales tax. This may include taxes on luxury items or specific products, as outlined in the NY DTF FT-943. Understanding these special taxes can help you accurately calculate total costs and stay compliant.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.