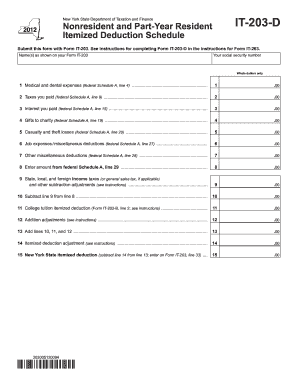

Get Ny Dtf It-203-d 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF IT-203-D online

How to fill out and sign NY DTF IT-203-D online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, the majority of Americans prefer to file their own income tax returns and also to fill out documents digitally.

The US Legal Forms online service simplifies the process of preparing the NY DTF IT-203-D, making it convenient.

Ensure you have accurately completed and submitted the NY DTF IT-203-D by the deadline. Consider any relevant time frames. Incorrect information on your financial documents can lead to significant penalties and complications with your annual tax return. Always use only reputable templates from US Legal Forms!

- Access the PDF form in the editor.

- Observe the highlighted fillable fields where you can enter your details.

- Click the option to select if you see checkboxes.

- Navigate to the Text icon and other useful features to customize the NY DTF IT-203-D manually.

- Review all information before proceeding to sign.

- Create your personalized eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Authorize your online template and specify the date.

- Click Done to proceed.

- Save or send the document to the intended recipient.

How to Modify Get NY DTF IT-203-D 2012: Personalize Forms Online

Streamline your document preparation workflow and tailor it to your needs with just a few clicks. Complete and sign Get NY DTF IT-203-D 2012 using a detailed yet user-friendly online editor.

Completing paperwork is often challenging, particularly when you do it sporadically. It requires you to meticulously follow all protocols and accurately fill out every section with complete and exact information. Nevertheless, there are times when you need to modify the form or add additional sections for completion. If you wish to refine Get NY DTF IT-203-D 2012 prior to its submission, the easiest method is by utilizing our robust yet simple online editing features.

This comprehensive PDF editing platform enables you to swiftly and efficiently complete legal documents from any device with internet access, make fundamental alterations to the form, and add supplementary fillable fields. The service allows you to specify a distinct area for each type of data required, such as Name, Signature, Currency, and SSN, among others. You can designate these fields as mandatory or conditional and determine who should complete each section by assigning them to specific recipients.

Follow these steps to enhance your Get NY DTF IT-203-D 2012 online:

Our editor is a flexible and feature-rich online tool designed to help you quickly and easily adjust Get NY DTF IT-203-D 2012 along with other forms to meet your specifications. Enhance document preparation and submission efficiency while ensuring your documentation appears professional without any complications.

- Access the necessary document from the directory.

- Complete the blanks with Text and place Check and Cross markers in the tick boxes.

- Use the right-hand panel to modify the template by adding new fillable sections.

- Select the areas based on the type of information you wish to collect.

- Mark these fields as mandatory, optional, or conditional and arrange their sequence.

- Assign each section to a specific participant using the Add Signer feature.

- Confirm that all necessary changes have been made and click Done.

Receiving mail from the New York State Department of Taxation and Finance usually relates to your tax filings or payments. They may contact you with questions, request additional information, or inform you about your tax obligations. If you find this communication confusing, consider consulting resources regarding the NY DTF IT-203-D or reaching out for professional advice.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.