Get Ny Dtf It-2105.9 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-2105.9 online

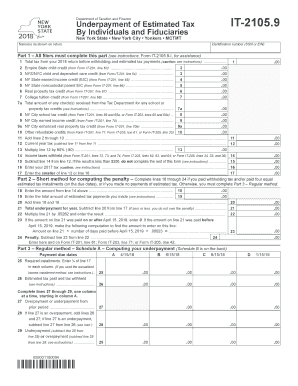

Navigating the process of completing the NY DTF IT-2105.9 form can seem daunting at first, but this guide simplifies each step, ensuring you have the necessary information to complete it accurately. This form is essential for individuals and fiduciaries to report and address underpayment of estimated taxes.

Follow the steps to successfully complete the NY DTF IT-2105.9 online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name(s) as shown on the return in the designated field.

- Provide your identification number, which can be either your Social Security Number (SSN) or Employer Identification Number (EIN).

- Complete Part 1 by entering the total tax from your prior year’s return before withholding and estimated tax payments on line 1.

- Record any applicable credits from your previous tax forms: Empire State child credit (line 2), NYS/NYC child and dependent care credit (line 3), NY State earned income credit (line 4), and others through line 10.

- Add lines 2 through 10 and enter the total on line 11.

- Calculate your current year tax by subtracting line 11 from line 1 and enter the result on line 12.

- Next, multiply your result on line 12 by 90% and enter that value on line 13.

- Document the total income taxes withheld as indicated on the required lines from your previous tax forms on line 14.

- Subtract line 14 from line 12. If the result is less than $300, you do not need to complete the remainder of the form.

- In line 16, input your tax amount from the previous year mentioned in the instructions, ensuring you check for accuracy.

- On line 17, enter the smaller of line 13 or line 16.

- Proceed to Part 2 if applicable, where you will compute the penalty using lines 18 through 24 based on your past payments.

- If you made no payments, you will need to complete Part 3, which involves detailed calculations for each installment of estimated tax.

- After completing the form, ensure all sections are checked for accuracy before proceeding to save changes, download, print, or share your document.

Begin filling out your form online today to ensure timely submission and compliance with tax requirements.

Get form

Whether you need to file a New York tax return depends on your income level and residency status. Generally, if your income exceeds certain thresholds, you are required to file. It's essential to review the guidelines carefully, as forgetting to file can result in penalties. For those unsure about their filing requirements, consulting the NY DTF IT-2105.9 form and additional resources from uslegalforms can provide clear direction.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.