Loading

Get Ny Dtf It-2663 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-2663 online

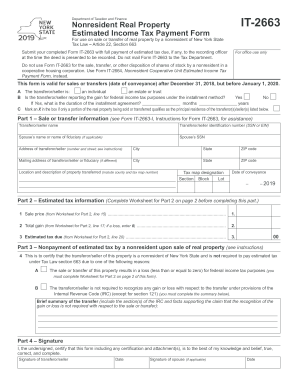

The NY DTF IT-2663 form is essential for nonresidents of New York State who are selling or transferring real property. This guide offers clear, step-by-step instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to fill out the NY DTF IT-2663 online

- Click ‘Get Form’ button to obtain the NY DTF IT-2663 form and access it for online completion.

- Begin by identifying the transferor or seller's status, marking the appropriate box as an individual, estate, or trust.

- If applicable, indicate whether the transferor/seller is reporting the gain for federal income tax purposes under the installment method and provide the duration of the installment agreement.

- Complete Part 1, which includes detailed information about the transferor/seller such as their name, identification number (SSN or EIN), address, and property location.

- Enter the date of conveyance and tax map designation details, including section, block, and lot numbers.

- For Part 2, fill out the estimated tax information using the worksheet provided, beginning with the sale price.

- Calculate total gain or loss from the sale by completing the worksheet for Part 2, inputting all relevant figures and computations.

- Complete Part 3 to certify any nonpayment of estimated tax due to a loss or lack of required gain recognition under the Internal Revenue Code.

- Affix signatures of the transferor/seller and spouse (if applicable), along with the date of signing in Part 4.

- Once all fields are completed, users can save changes, download, print, or share the form as required.

Complete your NY DTF IT-2663 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

NYS DTF sales tax is a tax imposed on the sale of goods and services in New York State, administered by the Department of Taxation and Finance. Businesses are responsible for collecting this tax from customers at the point of sale and remitting it to the state. Properly managing sales tax is essential for business compliance and can be easily tracked using solutions like USLegalForms to streamline your reporting process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.