Get Ny Dtf Nyc-204ez 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF NYC-204EZ online

How to fill out and sign NY DTF NYC-204EZ online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Nowadays, the majority of Americans choose to manage their own income taxes and, in addition, to complete reports electronically.

The US Legal Forms online platform simplifies the e-filing process for the NY DTF NYC-204EZ, making it straightforward and convenient.

Ensure that you have accurately completed and submitted the NY DTF NYC-204EZ on time. Keep in mind any relevant deadlines. Providing incorrect information on your financial statements can result in hefty penalties and complications with your yearly tax return. Use only approved templates with US Legal Forms!

- Start by opening the PDF template in the editor.

- Look at the designated fillable sections where you can enter your details.

- Select the option by clicking on the checkboxes you encounter.

- Utilize the Text tool and various advanced features for manual modification of the NY DTF NYC-204EZ.

- Double-check all pieces of information prior to proceeding with your signature.

- Create your distinct eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Authenticate your web template online and specify the exact date.

- Click Done to proceed further.

- Download or forward the document to the recipient.

How to modify Get NY DTF NYC-204EZ 2017: personalize forms online

Take advantage of the functionality of the versatile web-based editor as you complete your Get NY DTF NYC-204EZ 2017. Utilize a variety of tools to swiftly fill in the gaps and provide the required information effortlessly.

Creating documents can be time-consuming and expensive unless you have pre-made fillable templates that you can complete digitally. The most efficient way to handle the Get NY DTF NYC-204EZ 2017 is by using our expert and multifunctional online editing tools. We equip you with all the essential instruments for rapid document completion and allow you to make any alterations to your templates, customizing them to fit any criteria. Additionally, you can comment on the modifications and leave messages for other participants.

Here’s what you can achieve with your Get NY DTF NYC-204EZ 2017 in our editor:

Disseminate the documents in different manners and store them on your device or cloud in various formats after you're done with the modifications. Using the Get NY DTF NYC-204EZ 2017 in our robust online editor is the quickest and most efficient approach to handle, submit, and distribute your documentation exactly how you require it from anywhere. The tool works from the cloud, allowing you to access it from any location on any internet-enabled device. All templates you create or modify are safely stored in the cloud, ensuring you can always retrieve them when necessary and feel secure about not losing them. Stop squandering time on manual document filling and eliminate paperwork; do everything online with minimal effort.

- Complete the empty fields using Text, Cross, Check, Initials, Date, and Signature features.

- Emphasize important information with a chosen color or underline it.

- Hide sensitive information with the Blackout feature or simply eliminate it.

- Add images to enhance your Get NY DTF NYC-204EZ 2017.

- Substitute the original text with content that meets your specifications.

- Include comments or sticky notes to inform others about the revisions.

- Insert additional fillable fields and assign them to specific individuals.

- Secure the document with watermarks, incorporate dates, and insert bates numbers.

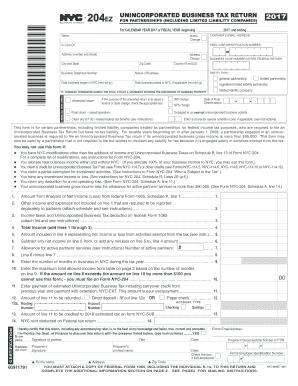

Partnerships that earn income from sources within New York are required to file a New York partnership return. This requirement holds true even if the partnership does not operate headquarters in the city. Familiarizing yourself with the NY DTF NYC-204EZ can help determine if you qualify for a more straightforward filing method.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.