Loading

Get Ny Dtf St-120.1 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF ST-120.1 online

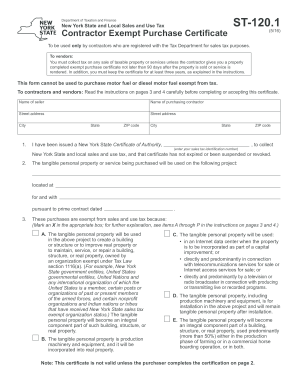

Filling out the NY DTF ST-120.1 form online is essential for contractors registered with the New York State Tax Department seeking an exemption from sales tax on specific purchases. This guide provides a clear, step-by-step approach to ensure that users complete the form accurately and efficiently.

Follow the steps to accurately fill out the form.

- Click 'Get Form' button to access the form and open it in the online editor.

- Enter the seller's name and the purchasing contractor's name in the designated fields.

- Fill in the street address, city, state, and ZIP code for both the seller and the purchasing contractor.

- Indicate your sales tax identification number, confirming that your New York State Certificate of Authority is valid and not expired.

- Enter the project details, including the project's address and the name of the project owner, along with the date of the prime contract.

- Select the appropriate box that describes the reason for the exemption. Ensure you understand the options A through P and mark the one that applies.

- Complete the required certification statement, including printing the name and title of the authorized person, followed by their signature.

- Fill in the date when the form is prepared to finalize the documentation.

- After completing the form, save your changes and download a copy, or print it directly.

Complete your NY DTF ST-120.1 online now for a seamless tax exemption process.

The New York City passthrough entity tax applies to partnerships and S corporations that conduct business in New York City. This tax is intended to alleviate the tax burden on individual partners and shareholders. Understanding this tax is crucial for these entities, and knowing forms like the NY DTF ST-120.1 may aid in navigating the complex tax environment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.