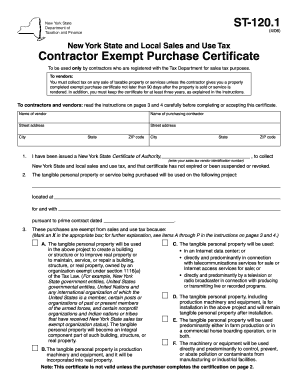

Get Ny Dtf St-120.1 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF ST-120.1 online

How to fill out and sign NY DTF ST-120.1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, a majority of Americans choose to handle their own tax returns and, in addition, to fill out forms digitally.

The US Legal Forms online platform facilitates the submission of the NY DTF ST-120.1 quickly and effortlessly.

Ensure that you have accurately completed and submitted the NY DTF ST-120.1 on time. Take into account any relevant deadlines. Providing incorrect information on your financial documents may lead to substantial penalties and complications with your yearly tax returns. Utilize only professional templates from US Legal Forms!

- Access the PDF template in the editor.

- Review the specified fillable fields. Here you can enter your information.

- Select an option if you notice the checkboxes.

- Explore the Text icon and other robust features to manually edit the NY DTF ST-120.1.

- Verify every detail prior to proceeding with the signature.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Validate your PDF form online and indicate the specific date.

- Select Done to continue.

- Download or forward the document to the recipient.

How to Modify Get NY DTF ST-120.1 2006: Personalize Forms Online

Experience a stress-free and paperless method of modifying Get NY DTF ST-120.1 2006. Utilize our reliable online platform and save a substantial amount of time.

Creating each document, including Get NY DTF ST-120.1 2006, from the beginning takes excessive time, so having a proven solution of preloaded form templates can do wonders for your efficiency.

However, altering them can be a challenge, particularly when dealing with files in PDF format. Thankfully, our extensive library includes a built-in editor that allows you to seamlessly complete and customize Get NY DTF ST-120.1 2006 without needing to exit our site, so you don’t waste your valuable time filling out forms. Here’s a guide for handling your file using our platform:

Whether you need to edit the customizable Get NY DTF ST-120.1 2006 or any other form obtainable in our catalog, you’re well-equipped with our online document editor. It’s user-friendly and secure and doesn’t necessitate any specific skills. Our web-based solution is designed to manage virtually every aspect you can imagine regarding document modification and execution.

Leave behind the conventional methods of managing your documents. Opt for a more effective solution to streamline your tasks and make them less reliant on paper.

- Step 1. Locate the required form on our platform.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize specialized editing tools that enable you to add, delete, annotate, and emphasize or obscure text.

- Step 4. Create and attach a legally-binding signature to your document by using the sign option from the upper toolbar.

- Step 5. If the form layout doesn’t appear as you desire, use the tools on the right to delete, add, and rearrange pages.

- Step 6. Insert fillable fields so that other individuals can be invited to fill out the form (if needed).

- Step 7. Distribute or send the document, print it, or choose the format in which you'd prefer to receive the file.

Related links form

To obtain a sales tax exemption certificate in North Carolina, you need to complete Form E-595E, where you declare your eligibility for exemption. This form requires you to provide specific details about your business and the nature of your exempt purchases. For guidance on completing this form correctly, USLegalForms offers resources to streamline the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.