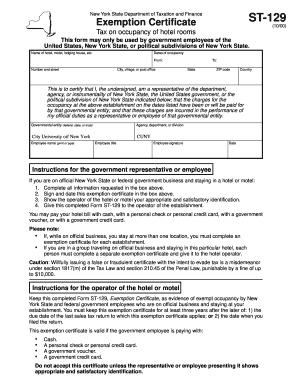

Get Ny Dtf St-129 2000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF ST-129 online

How to fill out and sign NY DTF ST-129 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, the majority of Americans seem to prefer to handle their own taxes and, indeed, to complete forms online.

The US Legal Forms web platform facilitates the process of preparing the NY DTF ST-129 simple and accessible.

Ensure that you have accurately completed and submitted the NY DTF ST-129 on time. Be mindful of any deadlines. Providing incorrect information in your tax filings can lead to significant penalties and complications with your yearly tax return. Utilize only professional templates from US Legal Forms!

- Open the PDF template in the editor.

- View the highlighted fillable areas. Here, you can enter your information.

- Click the option to select if checkboxes appear.

- Explore the Text tool and other advanced features to manually modify the NY DTF ST-129.

- Verify all the information before you proceed with signing.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Sign your PDF form electronically and enter the specific date.

- Click on Done to continue.

- Save or send the document to the recipient.

How to modify Get NY DTF ST-129 2000: personalize forms online

Utilize our extensive online document editor while finalizing your paperwork. Complete the Get NY DTF ST-129 2000, focus on the most important aspects, and easily make any other necessary changes to its content.

Finalizing documentation digitally is not only efficient but also provides a chance to adjust the template according to your preferences. If you’re about to handle the Get NY DTF ST-129 2000, think about finalizing it with our thorough online editing tools. Whether you make a mistake or input the needed information in the wrong section, you can promptly modify the form without having to start over as you would with manual completion. Moreover, you can highlight the crucial information in your documents by accentuating certain elements with colors, underlining them, or circling them.

Our broad online services offer the easiest method to complete and personalize Get NY DTF ST-129 2000 according to your specifications. Use it to create personal or business documents from anywhere. Access it in a browser, make any modifications to your forms, and revisit them at any time in the future - everything will be securely stored in the cloud.

- Access the form in the editor.

- Input the required information in the blank fields using Text, Check, and Cross tools.

- Follow the form navigation to ensure you don’t overlook any essential fields in the template.

- Circle some of the key details and add a URL to it if needed.

- Utilize the Highlight or Line options to emphasize the most important elements of the content.

- Select colors and thickness for these lines to give your sample a professional appearance.

- Erase or blackout the information you wish to keep hidden from others.

- Replace sections of content with inaccuracies and input the text that you require.

- Finalize modifications by clicking the Done button once you confirm everything is accurate in the form.

To get an IRS tax clearance certificate, you'll typically need to file IRS Form 8809 for an extension of time to file. Upon approval, the IRS will verify your tax compliance and issue the certificate. If you're contemplating the NY DTF ST-129 process, remember that coordinating both state and federal requirements will streamline your overall tax compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.