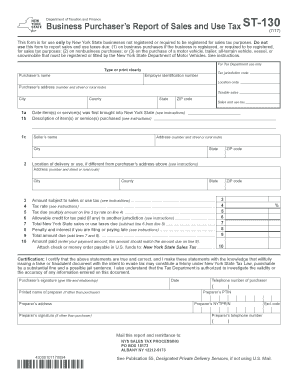

Get Ny Dtf St-130 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF ST-130 online

How to fill out and sign NY DTF ST-130 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, the majority of Americans favor handling their own taxes and, in addition, completing forms digitally.

The US Legal Forms online service simplifies the process of e-filing the NY DTF ST-130, making it straightforward and user-friendly.

Make sure you have accurately filled out and submitted the NY DTF ST-130 by the deadline. Be aware of any due dates. Providing inaccurate information in your financial reports may lead to hefty penalties and complications with your yearly tax return. Only utilize validated templates from US Legal Forms!

- Examine the PDF template in the editor.

- Consult the designated fillable spaces. Here you can enter your details.

- Choose the option by selecting the applicable checkboxes.

- Utilize the Text tool and additional advanced options to manually modify the NY DTF ST-130.

- Double-check every piece of information before you proceed to sign.

- Create your personalized eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Authenticate your PDF form electronically and specify the date.

- Click Done to advance.

- Download or send the document to the intended recipient.

How to modify Get NY DTF ST-130 2017: personalize forms online

Provide the appropriate document management features at your fingertips. Complete Get NY DTF ST-130 2017 with our reliable service that includes editing and electronic signature options.

If you wish to finalize and certify Get NY DTF ST-130 2017 online effortlessly, then our cloud-based solution is the ideal choice. We offer an extensive template-driven library of ready-made documents that you can modify and complete online. Additionally, there is no need to print the form or utilize external services to create fillable versions. All essential functionalities will be at your disposal as soon as you access the document in the editor.

Let’s explore our online editing features and their primary functions. The editor features an intuitive interface, making it quick to learn how to use it. We will examine three key elements that enable you to:

In addition to the features mentioned, you can protect your document with a password, apply a watermark, convert the document to your preferred format, and much more.

Our editor makes altering and certifying the Get NY DTF ST-130 2017 effortless. It allows you to accomplish nearly anything concerning document management. Furthermore, we consistently ensure that your document editing experience is secure and adheres to the primary regulatory standards. All these factors make employing our tool even more enjoyable.

Obtain Get NY DTF ST-130 2017, make the required adjustments and modifications, and receive it in the desired file format. Give it a try today!

- Revise and annotate the template

- The upper toolbar includes features that allow you to emphasize and obscure text, excluding images and graphic elements (lines, arrows, checkmarks, etc.), sign, initial, date the document, and more.

- Manage your documents

- Utilize the left toolbar if you would like to rearrange the document or remove pages.

- Prepare them for distribution

- If you want to make the document fillable for others and share it, you can use the tools on the right to add various fillable fields, signature and date options, text boxes, etc.

Related links form

New York State exempts specific items from sales tax, including most food purchases, prescription medications, and certain services. Additionally, clothing and footwear priced under $110 are tax-exempt. To navigate these exemptions effectively, having a clear understanding of the rules outlined by the state can be beneficial. Resources like uslegalforms can provide clarity on how to apply this knowledge in practice.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.