Loading

Get Ny Dtf St-131 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF ST-131 online

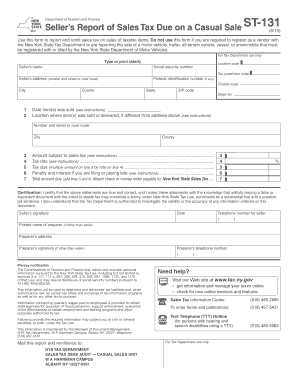

The NY DTF ST-131 form is essential for reporting and remitting sales tax on casual sales of taxable items. This guide provides a detailed walkthrough to help users complete the form accurately and efficiently online.

Follow the steps to fill out the form online

- Press the ‘Get Form’ button to access the NY DTF ST-131 and open it in your online editor.

- Fill in the seller's name at the top of the form, ensuring it is clearly typed or printed.

- Provide the seller's social security number and mailing address, including the street number and name.

- If applicable, enter the federal identification number. This may not be necessary for all users.

- Identify the location code and tax jurisdiction code relevant to your sale.

- Report the amount of taxable sales clearly in the designated field.

- Enter the city and county of the seller's address. Include the ZIP code for completeness.

- Indicate the sales tax amount collected based on the sale price of the items sold.

- Fill in the date of the sale — this is when either the item or payment was exchanged.

- If the item was sold or delivered to a different location, provide that address in the respective fields.

- Complete the amount subject to sales tax, ensuring it reflects all applicable handling and transportation charges.

- Input the jurisdiction's tax rate for the sale based on the seller's address or delivery address, if applicable.

- Calculate the total tax due by multiplying the amount subject to tax by the applicable tax rate.

- If the report or payment is being filed late, include any penalties and interest as necessary.

- Add both lines for total amount due and ensure to attach a payment method if required.

- Make sure to certify the accuracy of the information by signing where indicated and including the date.

- Finalize by reviewing all entered information before choosing to save changes, download, print, or share the completed form for submission.

Complete your NY DTF ST-131 form online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To cancel your NYS estimated tax payment, you should contact the New York State Department of Taxation and Finance directly. This process helps you adjust your payment plan based on any changes in income or financial circumstances. When using the NY DTF ST-131 form, keep in mind that managing your estimated payments effectively is crucial for maintaining proper tax compliance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.