Get Ny Dtf St-131 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF ST-131 online

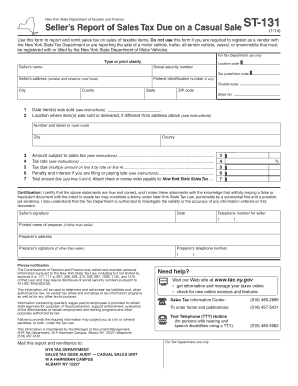

The NY DTF ST-131 form is essential for reporting and remitting sales tax on casual sales in New York. This guide provides a clear and supportive approach to filling out the form online, ensuring you understand each component and step involved in the process.

Follow the steps to successfully complete the NY DTF ST-131 online.

- Press the ‘Get Form’ button to access the DTF ST-131 form and open it in your document editor.

- Fill in the seller's name and social security number on the form. Ensure that all information is entered clearly and accurately.

- Complete the seller's address by providing the street number, city, county, and ZIP code. This ensures the tax department can reach you if needed.

- If applicable, enter your federal identification number. This is important for tax records and identification.

- Provide the date the item(s) was sold in the designated space. This is crucial as it determines the timeframe for tax remittance.

- Indicate the location where the item(s) was sold or delivered if different from the seller’s address. Include all necessary details such as street, city, and state.

- Enter the sale price of the item, including any handling or transportation charges, in the amount subject to sales tax section.

- Next, identify the tax rate applicable to the sale based on the jurisdiction. If unsure, refer to the tax rate chart provided in the form.

- Calculate the tax due by multiplying the amount subject to sales tax by the tax rate you have entered.

- If applicable, include any penalties or interest due if you are filing or paying late. Ensure you have calculated this correctly.

- Total the amount due by adding the tax due to any penalties or interest. Make sure this number is accurate for processing your payment.

- Sign and date the certification section of the form, acknowledging that the information provided is accurate and true.

- Once all sections are completed, save the changes you made to the form. You can then download, print, or share the form as needed.

Complete your NY DTF ST-131 form online today to ensure timely reporting and compliance with New York tax laws.

Get form

DTF stands for Department of Taxation and Finance, which is the agency responsible for collecting taxes in New York State. This department oversees various tax-related functions, including processing tax payments and ensuring compliance with the state's tax laws. By understanding what DTF represents, you can better navigate your obligations and utilize documents like the NY DTF ST-131 in your tax planning. If you seek further clarity or assistance, check with uslegalforms for user-friendly guidance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.