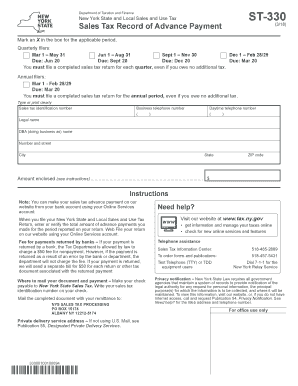

Get Ny Dtf St-330 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF ST-330 online

How to fill out and sign NY DTF ST-330 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Nowadays, the majority of Americans choose to handle their own income taxes and actually prefer to complete forms online.

The US Legal Forms online service streamlines the e-filing of the NY DTF ST-330, making it quick and straightforward.

Make sure you have accurately filled out and submitted the NY DTF ST-330 on time. Check for any relevant terms. Providing incorrect information in your financial documents can result in serious penalties and complicate your annual tax filing. Ensure to utilize only certified templates with US Legal Forms!

- Open the PDF template in the editor.

- Look at the highlighted fillable areas. This is where you will enter your information.

- Select the option when you see the checkboxes.

- Use the Text tool and additional advanced features to edit the NY DTF ST-330 as needed.

- Review all the information before you proceed to sign.

- Generate your unique eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Authenticate your PDF form electronically and input the specific date.

- Click Done to continue.

- Download or send the document to the intended recipient.

How to modify Get NY DTF ST-330 2018: personalize documents online

Experience a hassle-free and paperless method of altering Get NY DTF ST-330 2018. Utilize our dependable online service and conserve a substantial amount of time.

Creating every document, including Get NY DTF ST-330 2018, from the ground up demands too much energy. Therefore, having a proven solution of pre-prepared form templates can greatly enhance your efficiency.

However, adjusting them can be challenging, particularly when dealing with PDF files. Fortunately, our extensive library features a built-in editor that allows you to swiftly complete and modify Get NY DTF ST-330 2018 without needing to exit our site, so you won't waste time altering your documents. Here’s how to manage your form using our tools:

Whether you need to finish editable Get NY DTF ST-330 2018 or any additional document offered in our library, you're on the right path with our online document editor. It's simple and secure and doesn’t require any special expertise. Our web-based solution is designed to manage nearly everything you might consider in relation to document editing and processing.

Stop relying on traditional ways to manage your forms. Opt for a professional solution to assist you in optimizing your tasks and reducing your reliance on paper.

- Step 1. Find the required form on our website.

- Step 2. Click on Get Form to access it in the editor.

- Step 3. Utilize specialized editing tools that enable you to add, delete, comment, and emphasize or obscure text.

- Step 4. Create and affix a legally-binding signature to your document using the sign feature from the upper toolbar.

- Step 5. If the document’s layout doesn’t appear as you wish, use the options on the right to delete, add, and rearrange pages.

- Step 6. Insert fillable fields so others can be invited to complete the document (if needed).

- Step 7. Share or send the document, print it out, or select the format you prefer to download the file.

To claim sales on your tax return, you must report your total sales income on your annual tax filing accurately. The NY DTF ST-330 can assist in detailing the sales tax collected during the year. It is essential to ensure all figures align with your documented sales records for compliance. Utilizing tax software or consulting with a tax professional can streamline this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.