Get Ny Dtf Tp-584 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF TP-584 online

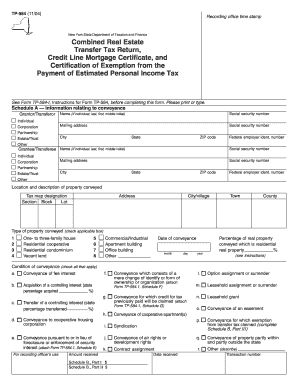

The NY DTF TP-584 form is essential for reporting the combined real estate transfer tax return, credit line mortgage certificate, and certification of exemption from estimated personal income tax. This guide will assist users in completing the form online, ensuring a smooth and efficient filing process.

Follow the steps to fill out the NY DTF TP-584 online effectively.

- Click ‘Get Form’ button to access the document and open it in your online editor.

- Begin filling out Schedule A by providing detailed information about the conveyance, including grantor and grantee information. Ensure to include names, social security numbers, mailing addresses, and types of entities.

- Next, describe the property being conveyed. Include the location, tax map designation, and the type of property being transferred.

- Specify the date of conveyance and indicate the percentage of the property that is residential real property.

- Complete the section for the condition of conveyance by checking all applicable boxes that describe the type of transfer.

- Move on to Schedule B to calculate the transfer tax. Input the consideration amount and any deductions as required.

- If applicable, fill out Part II of Schedule B for additional tax due on residential property valued at $1 million or more.

- If claiming an exemption, complete Part III of Schedule B by checking the relevant boxes and providing explanations.

- For Schedule C, certify whether the property is subject to a credit line mortgage, selecting the appropriate option.

- Finally, if required, complete Schedule D for certification of exemption regarding estimated personal income tax, ensuring all signatures are included.

- Review all entered information for accuracy, save your changes, and choose to download, print, or share the completed form as needed.

Complete your NY DTF TP-584 form online for a straightforward filing experience.

Get form

Receiving nonresident income from New York sources indicates that you earned income from activities or investments connected to New York State but reside elsewhere. This can include rental income, capital gains, or wages. Properly reporting such income, including any applicable taxes, is essential to ensure compliance with state tax laws, including those reflected in the NY DTF TP-584.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.